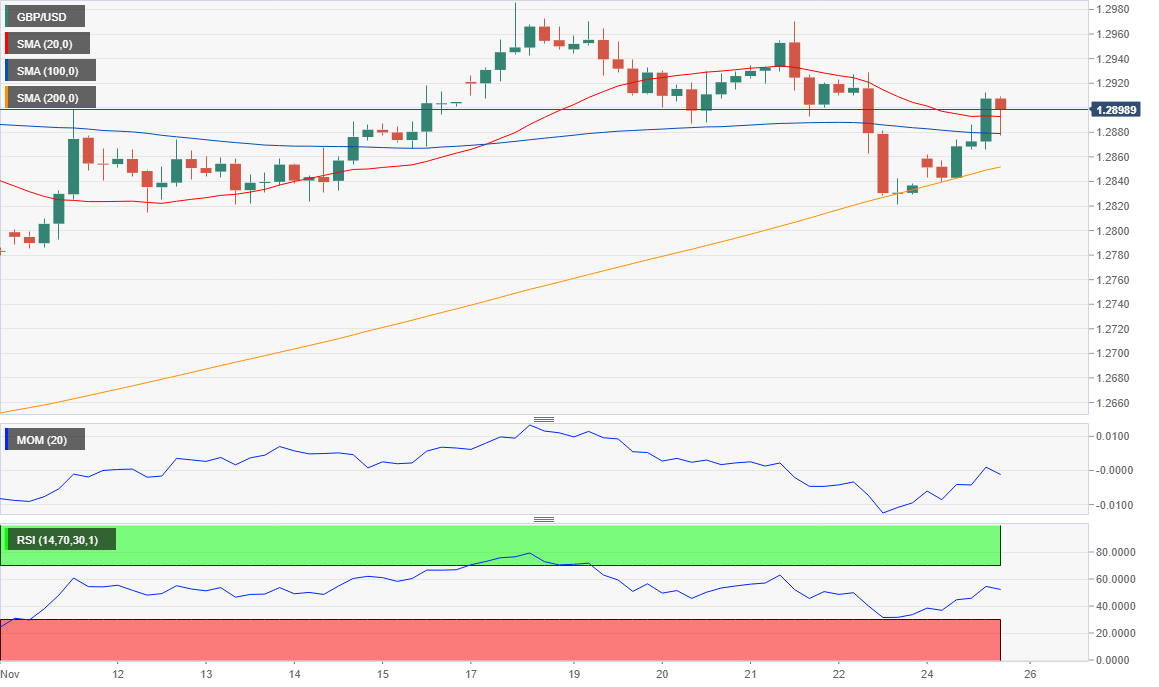

GBP/USD Current Price: 1.2898

- The latest UK election poll showed that Conservatives lead narrowed to 7.0%.

- The UK CBI Distributive Trade Survey on realized sales surprised on the upside in November.

- GBP/USD held above a critical mid-term support at around 1.2810.

The Pound was the exception to the rule, gapping higher at the weekly opening and surging against the greenback to 1.2911 during US trading hours. The positive momentum of the UK currency was backed by renewed optimism related to Brexit, as weekend polls showed that Conservatives continued leading voting intentions. The GBP/USD pair shed some 30 pips mid-American afternoon, following the release of a survey from ICM/Reuters, which showed the Conservatives at 41% and Labour at 34%, with Conservatives lead narrowing from over 10% to 7%.

The UK released earlier today the CBI Distributive Trade Survey on realized sales, which improved in November to -3% from the previous -10%. This Tuesday, the kingdom’s calendar will remain light, with the only figure scheduled being the October BBA Mortgages Approvals.

GBP/USD Short-Term Technical Outlook

The GBP/USD pair is trading in the 1.2890 region by the end of the American session, neutral in the short-term, as, in the 4 hours chart, the price is battling with directionless 20 and 100 SMA, but above a bullish 200 SMA. Technical indicators lack directional strength, although the Momentum is leaning lower within negative territory, while the RSI steadies around its mid-line. The pair has managed to recover from the 1.2810 price zone, where it has a critical Fibonacci support. Slides will likely remain contained as long as the price holds above this last.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.