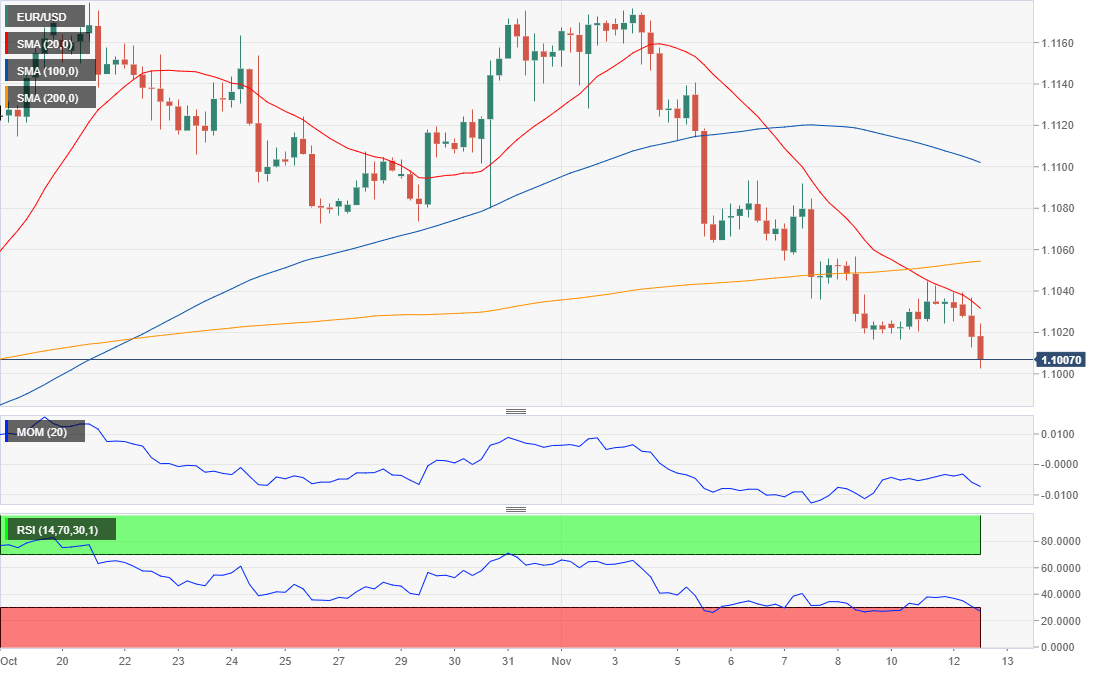

EUR/USD Current Price: 1.1007

- There were no updates on the US-China trade deal, but speculative interest returned to the dollar.

- US Federal Reserve’s Chief Powell is due to testify before the Congress this Wednesday.

- EUR/USD bearish momentum to accelerate once below 1.0990 Fibonacci support.

The EUR/USD pair edged lower this Tuesday, falling to a fresh four-week low of 1.1002, as poor EU data coupled with a renewed dollar’s demand. Germany released the November ZEW survey on Economic Sentiment, which came in at -2.1, much better than the previous -22.8 and the expected -13. However, the same index for the whole Union fell once again printing -24.7 from a previous -25.3. The US published the NFIB Business Sentiment Index for October which improved from a previous 101.8 by coming in at 102.4 but missed the market’s expectations of 103.5.

The market was hoping that US President Trump, who spoke at the Economic Club of New York, would comment on the US-China trade deal developments, but instead, he charged against the Federal Reserve’s monetary policy of keeping rates at higher levels than its major world counterparts. About the country’s relationship with China, Trump said that tariffs would rise substantially if they don’t make a deal.

This Wednesday, the main event will be US Federal Reserve’s chief, Jerome Powell, testimony before the Congress. Earlier in the day, Germany will release October final inflation data, seen stable at 1.0% YoY. The US will also release October CPI, with the yearly figure seen at 1.7%.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair is heading into the Asian session trading at its lowest in four weeks, not far above the mentioned low. The pair has broken below the 50% retracement of its October monthly rally at around 1.1030, with the 61.8% retracement of the same rally at 1.0992, providing support. The short-term picture is bearish, as, in the 4-hour chart, selling interest rejected advances multiple times around a bearish 20 SMA, which keeps sliding below the larger ones. Technical indicators lack clear directional strength but remain within negative levels, keeping the risk skewed to the downside.

Image by martaposemuckel from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.