- EUR/USD has bounced from fresh two-year lows amid a rocky ECB decision.

- US GDP is closely watched, and the detail may matter more than the headline.

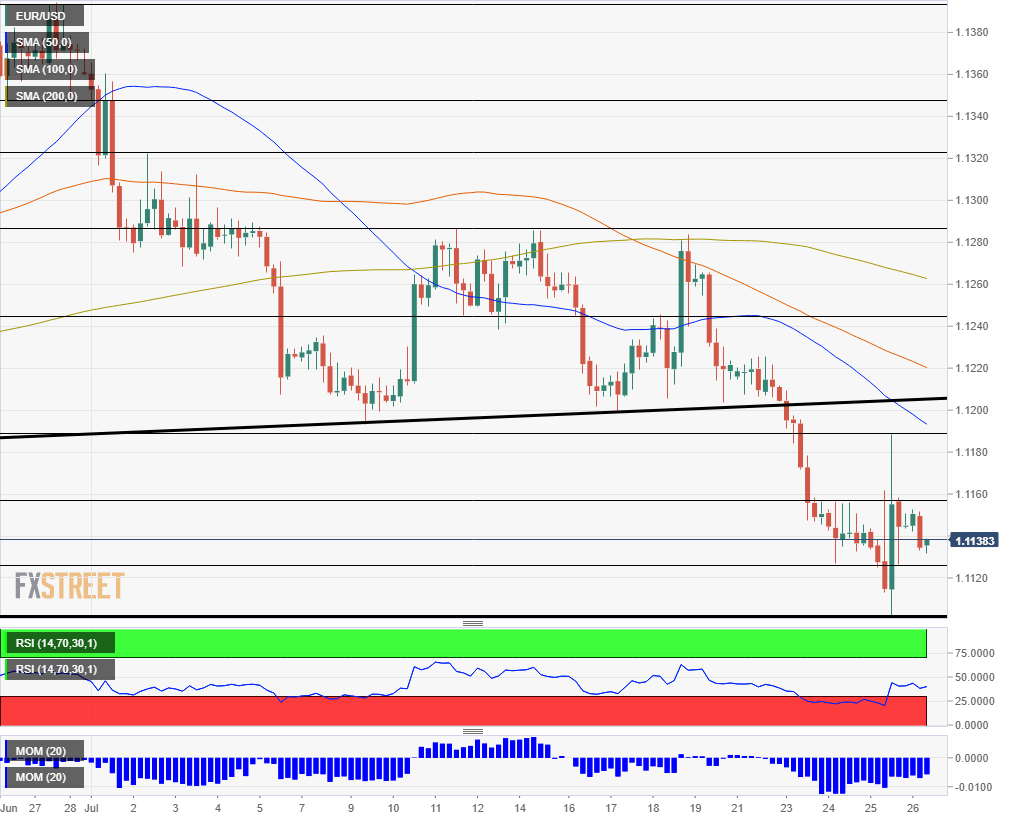

- Friday's four-hour chart points to potential falls for the currency pair.

Draghi's drama has failed to push EUR/USD too low – but the currency pair may suffer another downside drift with US GDP.

The European Central Bank has left its policies unchanged but opened the door to cutting rates and also restarting the Quantitative Easing program in September. Mario Draghi, President of the ECB, has said that the outlook is getting "worse and worse." At first, it seemed that Draghi succeeded to send the euro down without changing his policy.

However, he also added that "it is hard to be gloomy" as the current situation is of ongoing growth, highlighting ongoing rises in wages. Moreover, he revealed that the decision to open the door to more QE was not unanimous and dismissed fears of a recession. These words helped the common currency recover.

Draghi also upped his rhetoric regarding needed government action – spending to curb a potential downturn. He mostly referred to Germany, whose manufacturing sector has been suffering a slump – and it may drag the whole continent down due to supply chains.

His words seemed to have fallen on deaf ears as Olaf Sholz, Germany's finance minister, rejected the need to open to the purse strings and seemed calm about the economy.

Focus shifts to the US

After the dust settled from the ECB event, EUR/USD began drifting lower again. This can be attributed to the upcoming ECB action in December and also due to USD strength. US Durable Goods Orders beat expectations with the non-defense ex-air component coming out at 1.9% – far above expectations for this "core of the core" gauge.

The upbeat durables figures raise expectations for today's first release of US second-quarter GDP despite a broader than expected trade balance deficit. The economic calendar shows estimates standing at a low growth rate of 1.8%, but real expectations are probably higher after the recent numbers.

Apart from the headline, the components may make a difference. If growth is slow due to a drop in inventories – the USD may rise as a quarter of depletion may be followed by one of replenishment. If consumer spending is high – as implied by retail sales – it may also support the greenback.

It is also essential to examine the underlying prices – aka the deflator. Markets were unimpressed by the strong 3.1% growth rate in the first quarter as it came on top of weak inflation. An increase in the deflator is expected now.

All in all, the danger for EUR/USD is far from over as upbeat US figures may send it down and ECB action is waiting around the corner.

EUR/USD Technical Analysis

EUR/USD has been getting used to the lower range, and downside momentum persists on the four-hour chart. Moreover, the recent bounce has taken the Relative Strength Index above 30 – exiting oversold conditions and opening the door to fresh falls.

Initial support awaits at 1.1125, which was a low point earlier last week. Thursday's new 2019 low of 1.1101 is critical support. Below, 1.1025 and 1.0900 are the next lines to watch, and they date back to 2017.

Some resistance awaits at 1.1155, which held EUR/USD down earlier this week. It is followed by 1.1190, which was the high point on Thursday. Next up, we find 1.1245, which served as both support and resistance earlier in July.

Image Sourced by Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.