- EUR/USD keeps the bid tone in the 1.1270/80 band.

- The 21-day SMA at 1.1285 challenges bulls’ aspirations

- Trade, ECB easing, Fed’s rate cut seen ruling the sentiment.

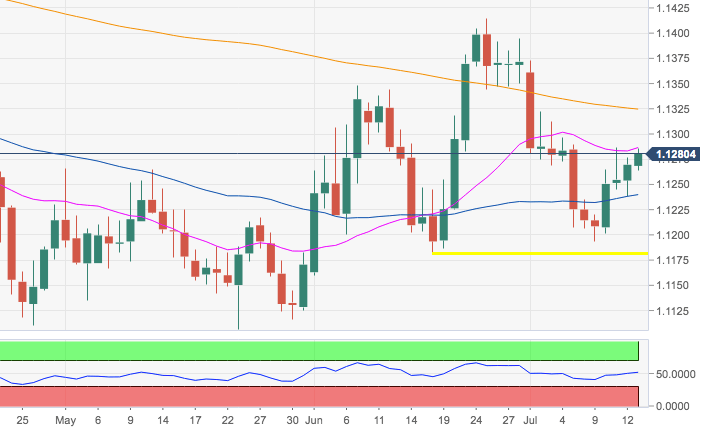

EUR/USD is extending the up move for yet another session on Monday, although the 1.1280/85 band has emerged as a tough nut to crack for the time being. This area is a coincident with the key 21-day SMA (1.1285).

Spot has gained ground almost exclusively on the back of USD-dynamics, namely rising speculations of a rate cut by the Federal Reserve as early as at this month’s meeting. The size of such a rate cut, however, still remains unclear for market participants.

However, EUR faces issues in its own backyard and not only stemming from the unremitting slowdown in the region, but also from the increasing probability that the ECB could cut rates in the near term along with a potential restart of the ‘quantitative easing’ (QE) and a probably change in the bank’s forward guidance.

In the meantime, developments from the US-China trade front and their impact on the broad risk appetite trends are expected to drive the sentiment in the near/medium term. In this regard, the US earnings season kicking in this week is seen collaborating with the mood as well. Data wise today, the greenback will be looking at the publication of the NY Empire State index.

Technically speaking, the 1.1181/76 band appears underpinning EUR/USD and is expected to hold the downside in the near term. On the way up, spot ideally needs to surpass the critical 200-day SMA at 1.1323 in order to alleviate downside pressure and allow for a new visit of monthly lows in the 1.1415/20 band.

Image sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.