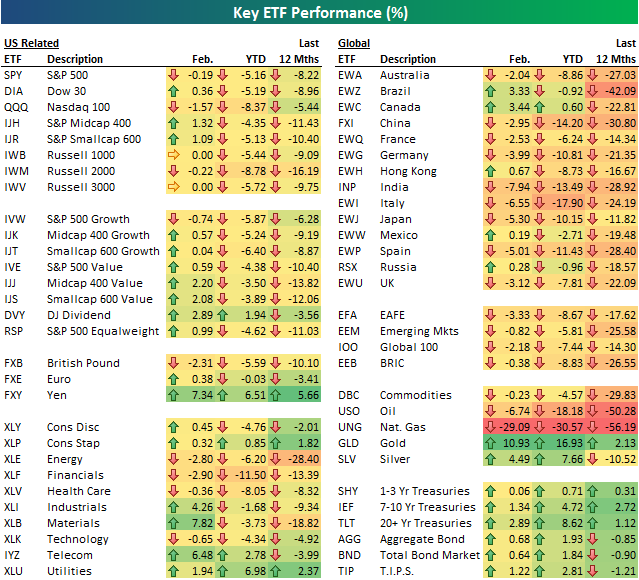

The first couple of months of 2016 have passed, and Bespoke decided to share an interesting snapshot of how several asset classes have performed so far. To measure this, the firm used key U.S.-traded ETFs, and evaluated their February, year-to-date and year-over-year returns.

The table below illustrates the performance of key ETFs. The ones on the left side of the matrix are mainly U.S. equity related; the ones on the right side represent international equities, commodities and fixed income.

Source: Bespoke

Source: Bespoke

The largecap SPDR S&P 500 ETF Trust SPY lost 19 basis points over February, while value ETFs gained about 2 percent. Out of the ten sectors considered by Bespoke, materials, industrials and telecom were among the best performers; energy, financials, healthcare and technology posted negative returns.

Regarding overseas markets, India, Italy, Japan and Spain finished the month down more than 5 percent. Meanwhile, Brazil and Canada surged about 3 percent.

A look at commodities shows that gold and silver were both big winners in February; over the same period, oil lost 6 percent, and United States Natural Gas Fund, LP UNG, 29 percent.

On the other hand, treasury ETFs retrieved gains across the board.

Disclosure: Javier Hasse holds no positions in any of the securities mentioned above.

Image Credit: Public Domain© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.