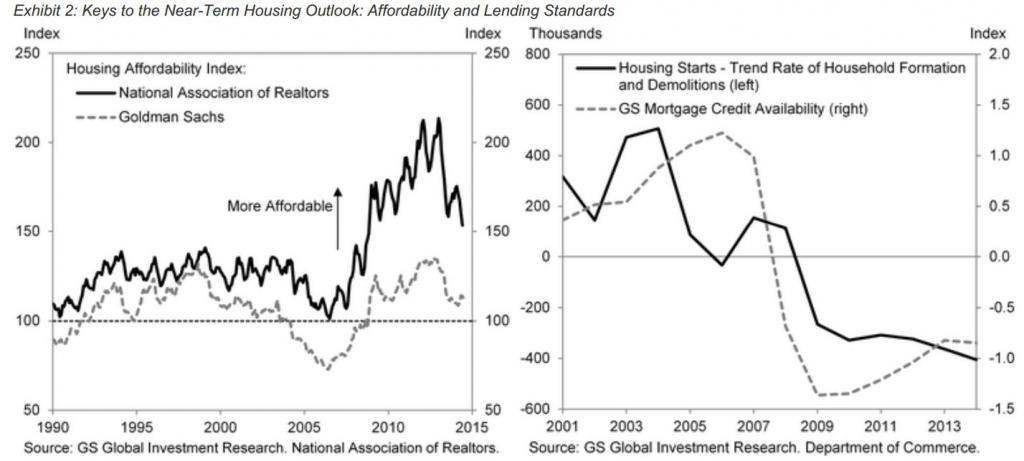

Housing as repeatedly been proclaimed as the strong driver of the U.S. recovery since 2009. According to Jan Hatzius at Goldman Sachs, the "tight mortgage lending standards have been an obstacle to the housing sector's recovery, a concern frequently highlighted by Fed Chair Janet Yellen." Without an increase in credit, the U.S. economic growth will experience long-term stagnation.

(Click To Enlarge)

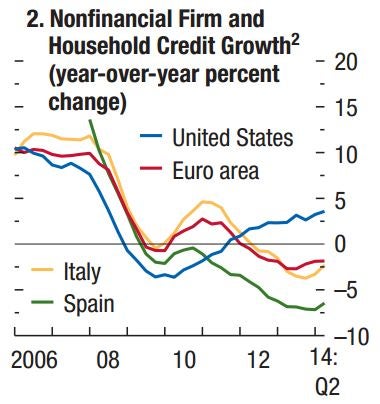

Alongside the Goldman Sachs claim of tight credit, the IMF shows that relative to other nations, the United States is the only one with an increase in non-financial household credit.

Cards could be falling as those at the largest, most European ingrained bank, conflicts with the very institution created by the United States to promote global stability in monetary systems.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.