The Fed on Wednesday is expected to cut Unemployment and Growth forecasts, while raising its Inflation forecasts as the group prepares to raise rates in 2015, keeping in-line with the expectations of consistent tapering of $10 billion per month.

For today though, the Street will be watching for the Fed to update its economic forecasts and policy guidance, offering a window for market participants to observe the key factors playing into the Central Banks' expected 2015 rate increase. The thesis going around the desks has been a delusion about the Fed seeking to carry out a planned agenda, as opposed to the private group being reactionary to the economic environment.

The current data and winter weather impact assurdely the group cautious.

The yield curve has been flattening and the inflection point is between the five and 10-year. Market makers Benzinga have spoken with in Chicago Fed Fund markets expect to see rates continue to drop. Over the past six months the 30- and 10-Year CMT have dropped, flattening the yield curve.

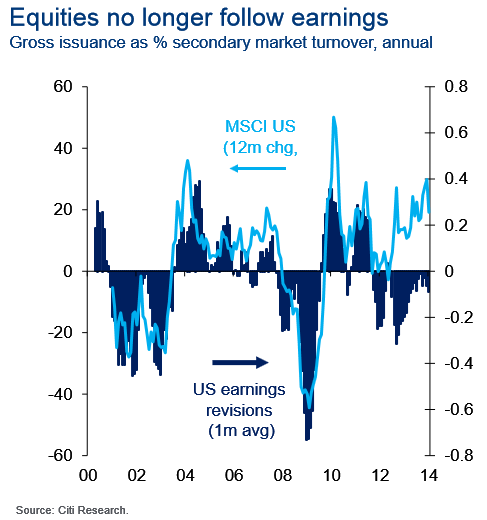

As even in the most basic equity market, valuations are not following earnings, according to a note released Tuesday by Citigroup’s Matt King.

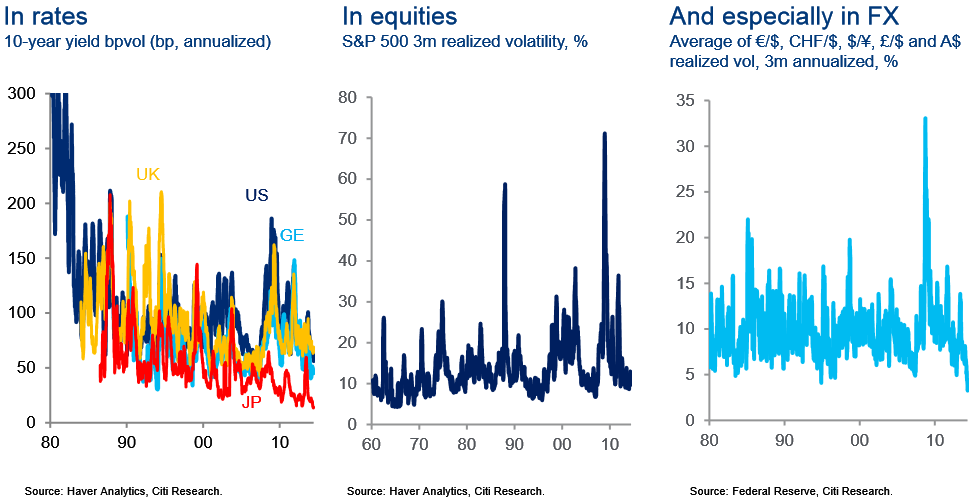

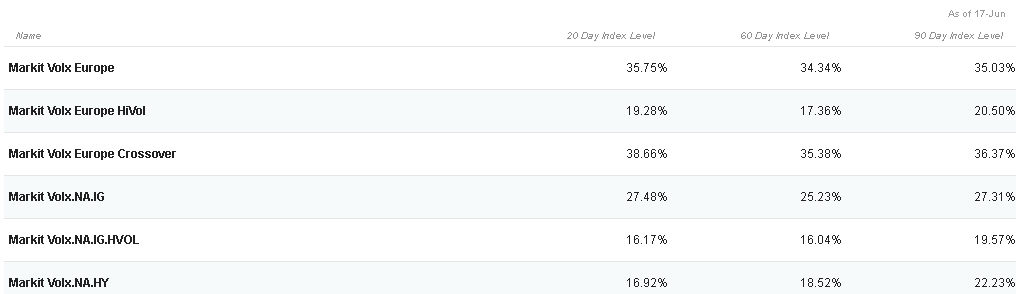

Gauging a consensus view of the Fed commentary Wednesday afternoon will be futile if one only focuses on traditional assets. As highlighted previously, the big money that the Fed seems to believe will come back and fill the void left after taper is complete and has been benefiting from cheap money and volatility in alternative asset markets.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.