The Broader Markets

The major indices were lower on the week and implied volatility spiked higher, with the VIX ending the week near 28.

SPY options are pricing about a 2.5% move in either direction for the upcoming week. That corresponds to about $370 to the downside and $390 on the upside. Here’s this week’s expected move chart via Options AI:

In the News

Beyond the weakness in the broader markets, former short squeeze/meme stocks like Gamestop GME were back in the news. Here’s Gamestop’s (GME) expected move for this week (nearly 50%) and over the next month (75%). Last week detailed the uniqueness of options pricing in high volatility stocks like Gamestop and how that could help inform trade types for directional views (you can read more about that here).

SPACs were in the news with large swings and similar to the meme stocks option volatility is higher. As an example, here’s the 30% monthly expected move in Churchill Capital Corp IV CCIV:

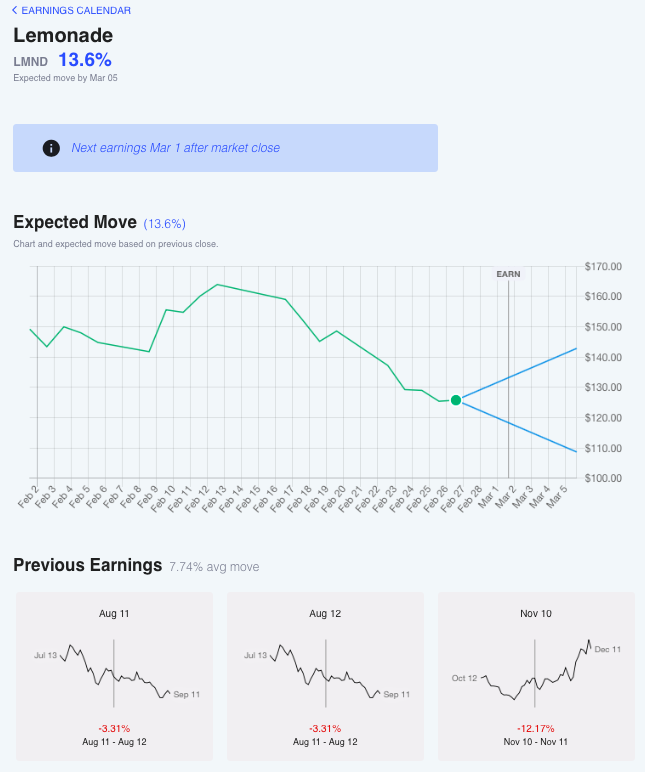

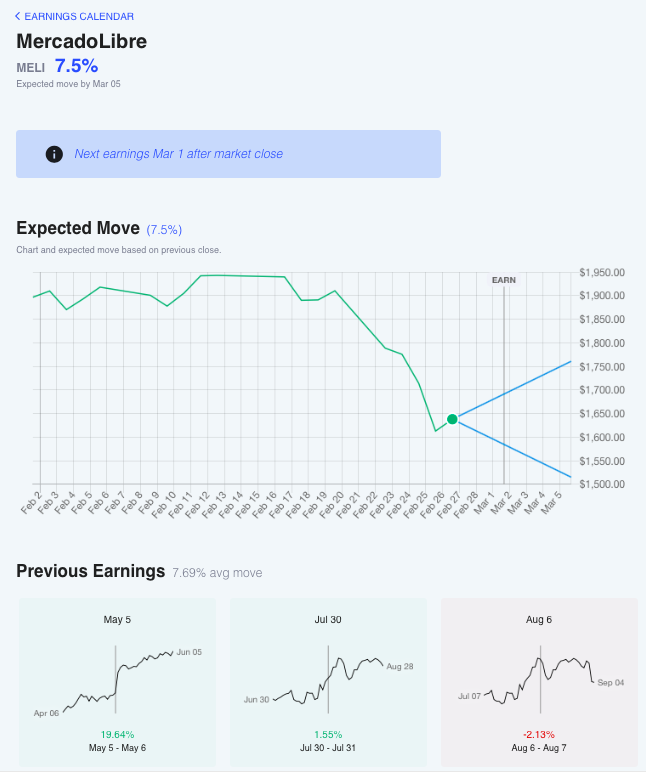

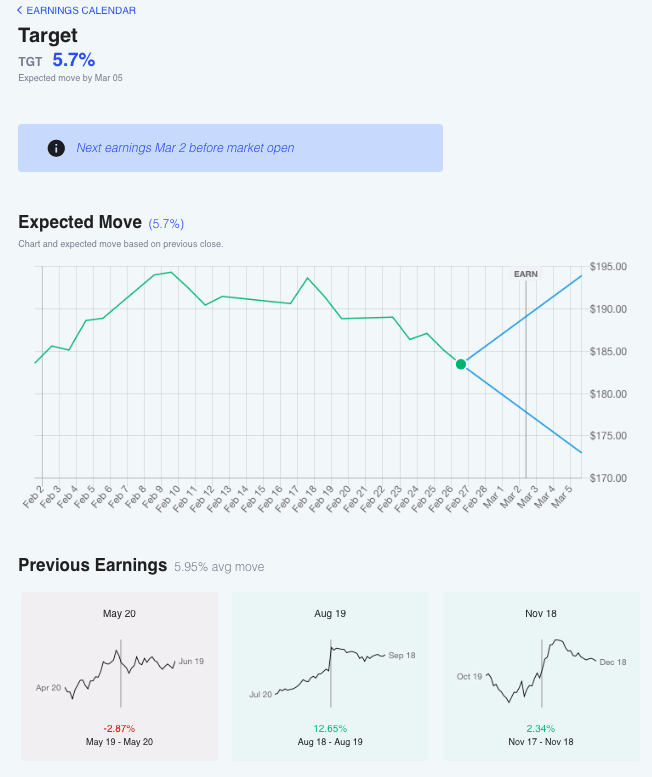

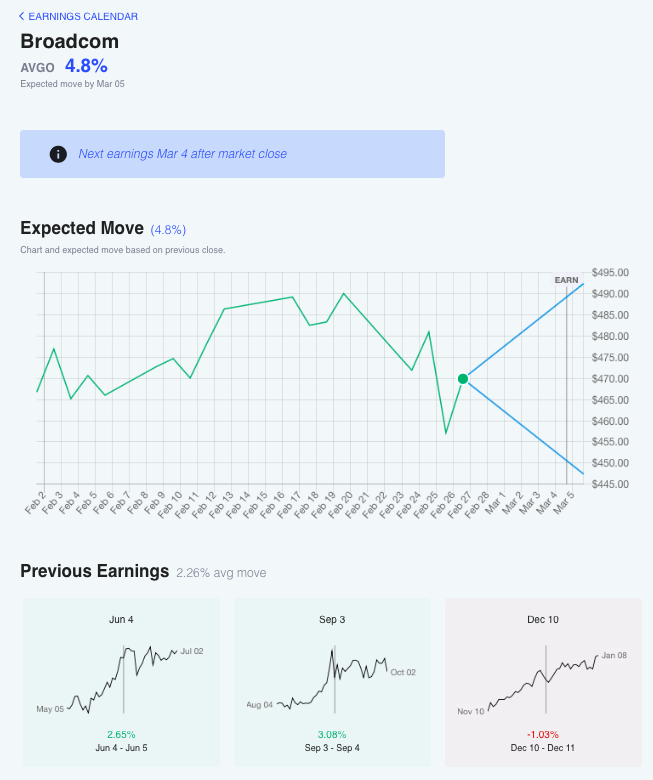

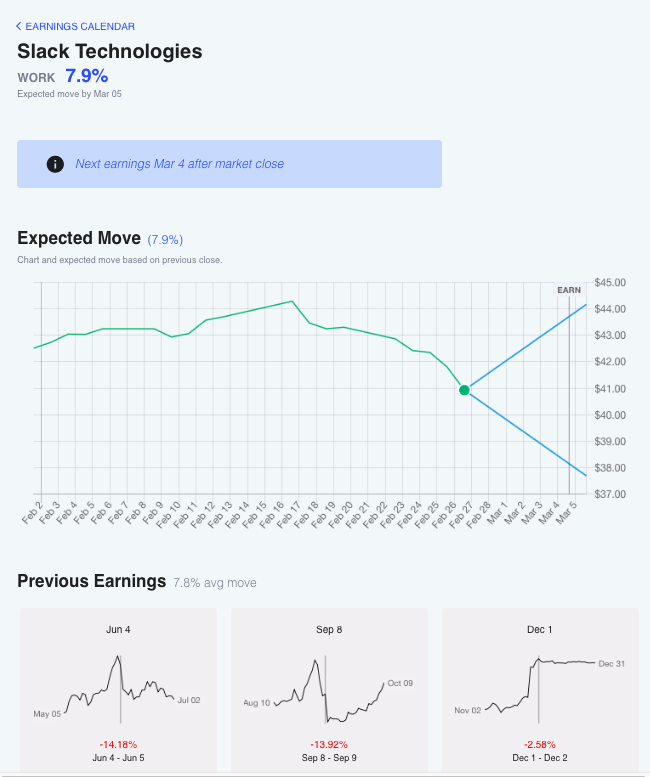

Expected Moves for Companies Reporting Earnings Next Week

Expected moves for some of the companies reporting earnings this week, with prior earnings moves below. A larger searchable list can be found on the Options AI Earnings Calendar.

Options AI puts the expected move at the heart of its chart-based platform and Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Date of Trade | ticker | Put/Call | Strike Price | DTE | Sentiment |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.