Shares of Abercrombie & Fitch ANF climbed nearly 6% on Tuesday after activist investor Engaged Capital called for the company to replace its CEO and consider strategic alternatives. For investors looking to add some downside protection in the event activists are unsuccessful in getting Abercrombie to right the ship, here are two was to hedge ANF.

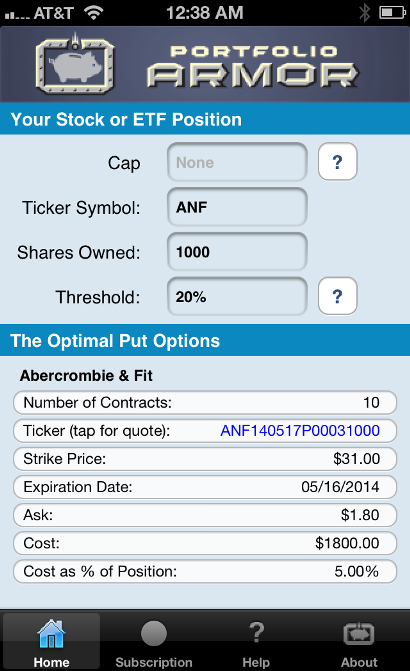

1) Hedging With Optimal Puts

Higher cost. Uncapped upside.

These were the optimal puts, as of Tuesday's close, to hedge 1000 shares of ANF against a greater-than-20% drop over the next several months.

As you can see at the bottom of the screen capture above, the cost of this protection, as a percentage of position value, was 5%.

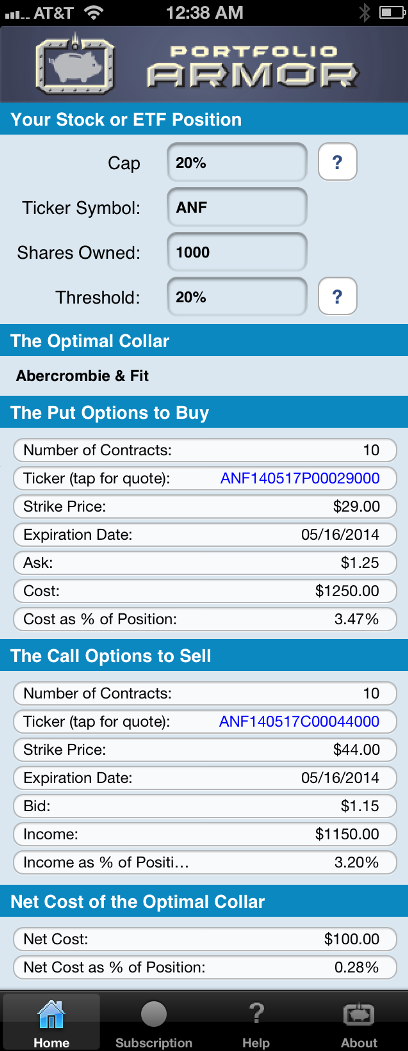

2) Hedging With An Optimal Collar

Lower cost. 20% upside cap.

If you were willing to cap your potential upside at 20% between now and May 16th, this was the optimal collar** to hedge 1000 shares of ANF against a greater-than-20% drop over the same time frame.

As you can see at the bottom of the screen capture above, the net cost of this collar, as a percentage of position value, was 0.28%.

Note that, to be conservative, Portfolio Armor calculated the cost of this hedge by using the bid price of the call leg and the ask price of the put leg. In practice, you can often sell calls for more (at some price between the bid and ask) and buy puts for less (again, at some price between the bid and ask), so, in actuality, an investor opening the collar above may paid less than $100 to do so in this case.

Possibly More Protection Than Promised

In some cases, hedges such as the ones above can provide more protection than promised. For a recent example of that, see this post about hedging shares of Tesla Motors, Inc. TSLA.

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.