Teen clothing retailer American Eagle Outfitters AEO dropped nearly 18% after hours Monday, after significantly lowering its earnings guidance. Out of curiosity, I checked the cost of hedging AEO during market hours on Monday, and it turns out AEO longs could have gotten paid to hedge before the earnings miss.

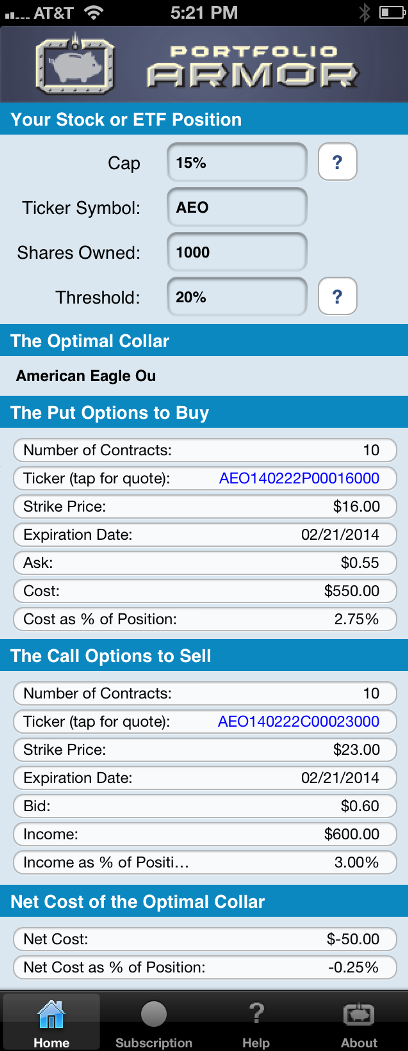

This was the optimal collar*, as of Monday's close, to hedge AEO against a >20% drop over the next several months, for an investor willing to cap his potential upside at 15% over the same time frame:

As you can see at the bottom of the screen capture below, the cost of this optimal collar was negative, meaning you would have gotten paid to hedge in this case.

It will be interesting to see how the put leg of the collar above reacts to AEO's drop during Tuesday's session.

*Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. Portfolio Armor’s algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.