Yahoo! Hits A 52-Week High, Six Months After Hiring Mayer

Shares of Yahoo!, Inc. YHOO hit a 52-week high on Monday -- the stock has climbed about 25% since the company announced it had hired Google, Inc. GOOG alumna Marissa Mayer to be its CEO last July.

Still Trading Well Below Microsoft's Rejected Buyout Offer

Although the last six months have been good for YHOO shareholders, as the chart above shows, the last six years have been less auspicious for them. It was six years ago, in 2007, that Microsoft, Inc. MSFT first offered to buy Yahoo for about $40 per share. Microsoft offered again to buy Yahoo! in 2008, before abandoning its bid, after Yahoo! rejected its final, $49.6 billion offer.

Hedging YHOO Against A >20% Drop

As we noted in a recent post, hedging a stock against a greater-than-20% drop can offer a reasonable compromise between limiting downside risk and lowering the cost of hedging. In this case, it could also serve to keep YHOO shareholders who bought the stock when Mayer was hired in the black: a 20% drop from Monday's closing price would take YHOO shares down to $16.72 -- about a dollar above where the shares traded on July 16th, 2012, when Mayer's appointment was announced.

Two Ways To Hedge YHOO

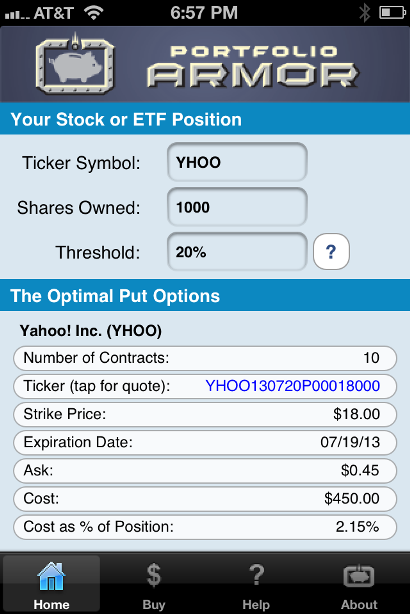

Below, we'll look at two different ways of hedging YHOO against a greater-than-20% decline. The first way uses optimal puts*; this way has a cost, but allows uncapped upside. These are the optimal puts, as of Monday's close, for an investor looking to hedge 1000 shares of YHOO against a greater-than-20% drop between now and July 19th:

As you can see in the screen capture above, the cost of those optimal puts, as a percentage of position, is 2.15%. Note that, to be conservative, cost here was calculated using the ask price of the optimal puts; in practice an investor can often buy puts for a lower price (i.e., some price between the bid and the ask). By way of comparison, the current cost of hedging the Nasdaq 100-tracking PowerShares QQQ Trust ETF QQQ against the same decline, over a somewhat longer frame (until September 20th), is 1.09% of position value.

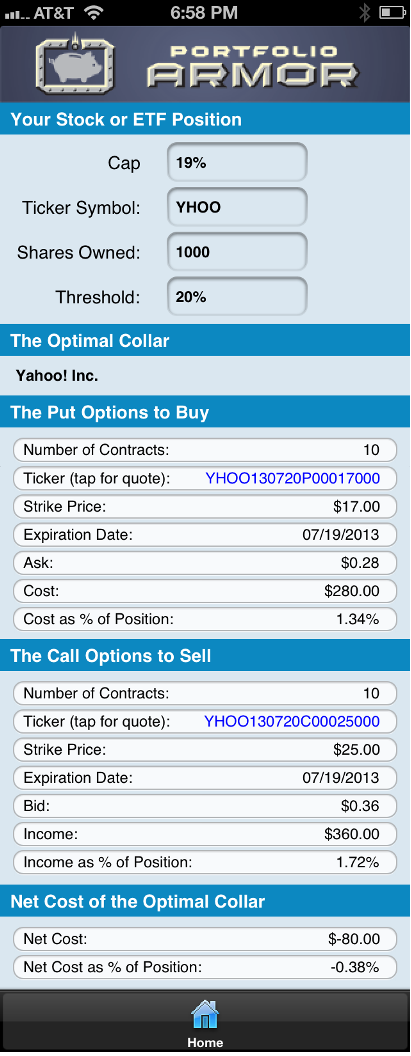

A YHOO investor interested in hedging against the same, greater-than-20% decline between now and July 19th, but also willing to cap his potential upside at 19% over that time frame, could use the optimal collar** below to hedge instead.

As you can see at the bottom of the screen capture above, the net cost of this optimal collar is negative -- meaning the YHOO investor would be getting paid to hedge in this case.

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance Ph.D to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University.

The screen captures above come from the latest build of the soon-to-come 2.0 version of the Portfolio Armor iOS app. Optimal collar capability will be available as an in-app subscription in the 2.0 version of the app.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.