Applied Materials Advances Ahead Of Price Target

Since closing at a 6 month low of $10.15 on November 16th, shares of Applied Materials, Inc. AMAT have been on a tear, rising 34%, as the chart below shows.

AMAT shares closed at $13.61 on Friday -- ahead analysts' consensus 12 month price target of $13.

With the company scheduled to release its fiscal 2013 first quarter earnings on Wednesday, investors who have held the stock during its recent run up may be considering adding downside protection to their positions. In this post, we'll look at two ways to hedge against a greater-than-20% drop in AMAT between now and late September.

Why Consider Hedging Against A >20% Drop

A twenty percent decline threshold is worth considering, because it lowers the cost of hedging somewhat (all things equal, the larger the potential loss you are looking to hedge against, the less expensive it is to hedge), and because a 20% decline is not necessarily an insurmountable one. To recover from a 20% loss, an investor would need a 25% rebound in his stock. But to recover from, say, a 35% drop, would require a rebound of nearly 54%

Two Ways To Hedge AMAT

The first way uses optimal puts*; this way has a cost, but allows uncapped upside. These are the optimal puts, as of Friday's close, for an investor looking to hedge 1000 shares of AMAT against a greater-than-20% drop between now and September 20th:

As you can see in the screen capture above, the cost of those optimal puts, as a percentage of position, is 3.89%. Note that, to be conservative, cost here was calculated using the ask price of the optimal puts; in practice an investor can often buy puts for a lower price (i.e., some price between the bid and the ask). By way of comparison, the current cost of hedging the Nasdaq 100-tracking PowerShares QQQ Trust ETF QQQ against the same decline, over the same time frame, is 1.10% of position value.

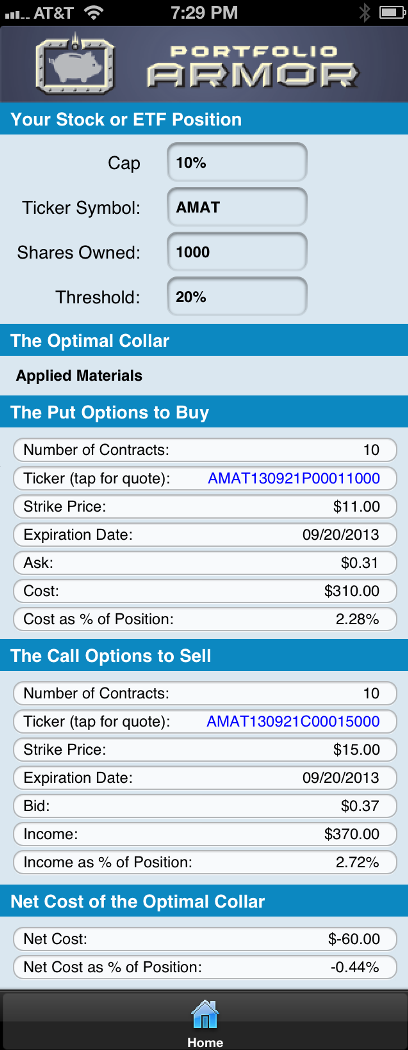

An AMAT investor interested in hedging against the same, greater-than-20% decline between now and September 20th, but also willing to cap his potential upside at 10% over that time frame, could use the optimal collar** below to hedge instead.

As you can see at the bottom of the screen capture above, the net cost of this optimal collar is negative -- meaning the AMAT investor would be getting paid to hedge in this case.

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance Ph.D to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University.

The screen captures above come from the latest build of the soon-to-come 2.0 version of the Portfolio Armor iOS app. Optimal collar capability will be available as an in-app subscription in the 2.0 version of the app.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.