Recent research suggests that the traditional financial system consumes much more energy than Bitcoin BTC/USD does.

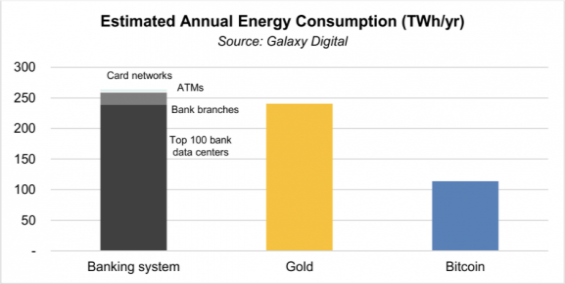

What Happened: According to a report by cryptocurrency bank Galaxy Digital, Bitcoin consumes 114 TWh of electrical energy per year, while the banking industry consumes over 260 TWh.

According to the study, Bitcoin uses 113.89 TWh, including the energy consumed by miners, mining service infrastructure, and network node power consumption.

Galaxy Digital points out that "the banking industry does not directly report electricity consumption," so estimating it was much harder than that of Bitcoin's, which is transparent and easy to track in real-time, using tools like the Cambridge Bitcoin Electricity Consumption Index.

Galaxy Digital Report

The traditional financial system uses multiple layers of settlements — unlike Bitcoin, which features final settlement — and Galaxy Digital estimates that banking data centers, bank branches, ATMs, and card network data centers use about 263.72 TWh globally.

This is 131.5% more than Bitcoin's estimated yearly consumption of 113.89 TWh.

The report was published after a tech tycoon and CEO of electric car manufacturer Tesla Inc TSLA, Elon Musk, announced that the company would stop accepting Bitcoin as means of payment due to environmental concerns.

The automaker implemented Bitcoin as a payment option in March after it had bought $1.5 billion worth of the cryptocurrency in February.

“Cryptocurrency is a good idea on many levels and we believe it has a prominent future, but this cannot come at great cost to the environment," Musk wrote in a recent tweet.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.