Bitcoin’s (BTC) market capitalization dominance stood below the 50% mark in the early hours of Wednesday at press time after 30 months of staying above that level.

What Happened: The apex cryptocurrency’s market dominance was 49.5% at press time, as resurgent altcoins brought an end to its majority dominance of the crypto market. Ethereum (ETH), which touched an all-time high of $2,702.91 on Tuesday, was second in terms of market dominance at 14.7%.

BTC traded 2.65% higher at $54,886.41, while ETH traded 5.51% higher at $2,634.94 at press time.

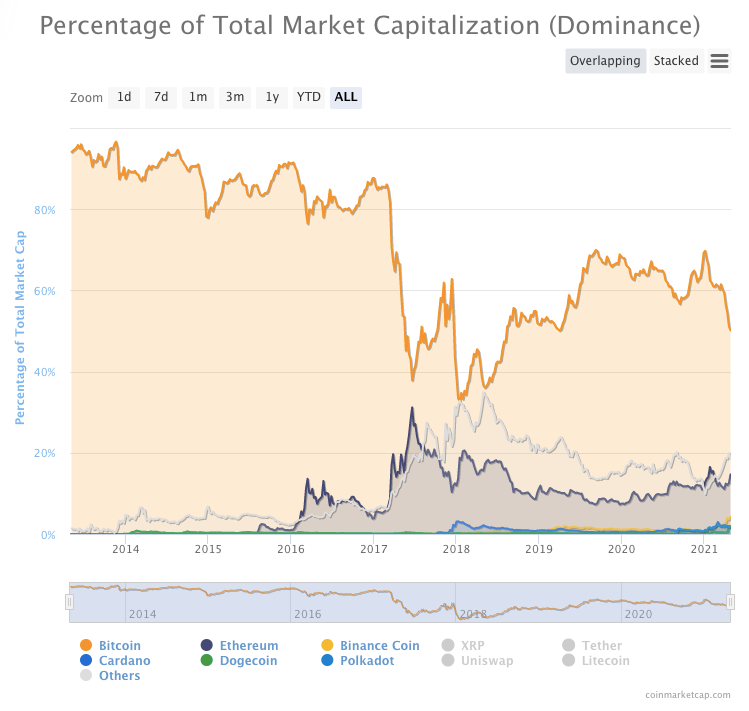

Market Dominance Of Various Cryptocurrencies and Bitcoin. Data From CoinMarketCap

Market Dominance Of Various Cryptocurrencies and Bitcoin. Data From CoinMarketCap

At the beginning of the year, BTC enjoyed a market dominance of over 70%, while ETH was nearly at the 11% level.

Dogecoin (DOGE), a cryptocurrency often discussed by Tesla Inc TSLA chief Elon Musk on social media, had a market dominance of 0.16% at the start of the year.

See Also: How to Buy Dogecoin (DOGE)

DOGE’s market dominance is currently 1.67%. The cryptocurrency has soared a whopping 5,563.55% since 2021 began and is currently trading 0.23% higher at $0.27.

Why It Matters: It was reported earlier that Bitcoin’s loss of market dominance could usher in an altcoin season. Analyst Michaël van de Poppe has predicted a “bullish summer” for altcoins.

Some of these altcoins have meanwhile seen their own market dominance rise even as Bitcoin’s declined.

Binance Coin (BNB) now has a market dominance of 4.18%, while Polkadot (DOT), and Cardano (ADA) enjoy dominance of 1.5% and 2% respectively.

At the beginning of the year, BNB and ADA had a market dominance of 0.7%, while DOT’s hovered around the 1% mark.

These cryptocurrencies have also risen considerably in price buoyed by the white-hot Decentralized Finance or DeFi arena.

Price increases in YTD terms are: 1,338.81% for BNB, 624.25% for ADA, and 256.62% for DOT.

Even smaller coins in terms of market capitalization have managed to gain in terms of market dominance.

PancakeSwap (CAKE) now has a market dominance of 0.27%, Dent (DENT) of 0.05%, and Stellar (XLM) of 0.55%.

Gainers among altcoins are primarily either compliments or competitors to Ethereum. Smart contract platforms enjoy a combined market cap of $474 billion, while DeFi related coins have one of $76.10 billion, as per Messari data. This has ushered in an era of so-called Ethereum killers.

Read Next: Ethereum Killers Are Advancing At Record Pace This Year: What You Need To Know

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.