- Ethereum has a bearish bias following up trending channel broken support.

- Ethereum is supported at $250 (100 SMA 1-h), $240, $230 and the key support at $225.

Ethereum has been on an upward trajectory since the establishment support at $225. The largest altcoin embarked on a gain-trimming exercise after the buyers failed to push the price above $300. Although a new 2019 high was from around $293, declines from the high explored the depth of the rabbit hole butchering key support levels at $280, $260 and $240.

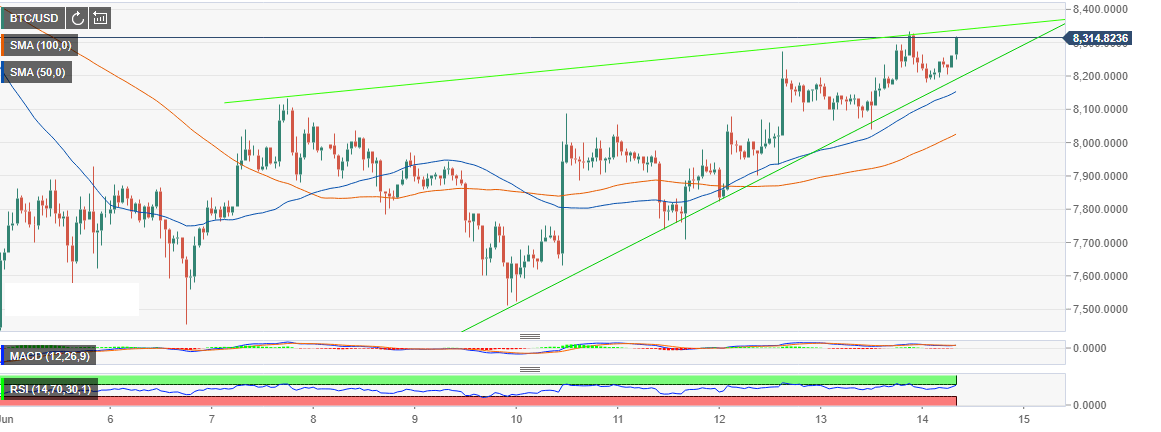

The trend this week has been more like a rollercoaster ride with Ethereum first extending the losses below $230 and then recovering from the $225 support within a rising channel as seen on the hourly chart. ETH/USD trading pair tested the levels close to $265 on Thursday, June 13 but overwhelming selling power capped the gains opening the door for a correction move.

The broken rising channel support further pushed the declines below $255 forming an intraday low at $252. The price currently hovers above $255, although ETH/USD has a bearish bias. The RSI sloping trend means that the bear momentum is gaining strength while the MACD sliding into the negative zone is a key indicator of bearish pressure and rising selling power.

Ethereum is supported at $250 (100 SMA 1-h), $240, $230 and the key support at $225. On the upside, $260 is a hurdle that has to be cleared for ETH to attack higher levels at $265 (seller congestion zone) and beyond.

ETH/USD 1-hour chart

Image Sourced by Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.