CNN’s business section took a deep dive into one of the oldest companies in the U.S.: Scotts Miracle-Gro SMG, which as we know has taken its own deep dive into the cannabis industry while keeping the rest of us supplied with what we need to keep our own spring gardens budding.

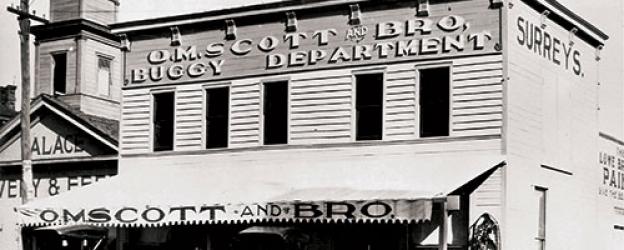

The 154-year-old company is headquartered in Marysville, Ohio, where Orlando M. Scott, after being discharged from the Union Army, began selling lawn seeds to individual homeowners in 1868. Scott's venture was based upon his firm conviction that "farmers need and shall have clean, weed-free fields."

By 1924, Scotts became the first company to ship grass seed products directly to stores, and the rest is history.

Photo courtesy of Scott's history page.

Now, Scotts is involved in the cultivation of a different kind of "grass," as many called marijuana in the 1960s.

Enter Hawthorne Gardening

Via its Hawthorne Gardening Company subsidiary, Scotts is involved in hydroponics, lighting and other supplies used for growing the bud-producing, flowering grass we now call cannabis.

From Grass Seed In Ohio To Cannabis Legalization Lobbying In DC

It seems now that Scotts is getting further involved by throwing its considerable lobbying weight behind federal cannabis legalization efforts, and "funneling money into investments that eventually could enable the company to sell cannabis directly to consumers," noted CNN.

The Place To Be, Says Company Exec

“It’s our belief, and this is not a grand revelation by any stretch: Federal legalization is obviously going to happen; the question is when and how,” said Chris Hagedorn, executive vice president of Scotts and division president of Hawthorne. “When it does, what are the most valuable assets going to be in a post-legalization world? I think anybody who thinks about it for a while says consumer-facing brands [that make and sell cannabis products] will be the most valuable.”

So long as cannabis continues to be federally illegal, Scotts cannot directly enter into the industry, so the company went the “picks and shovels” route by targeting the tools used to cultivate the plant itself.

Synergy In Action

With Scotts connection to Hawthorne Gardening, the road became clearer - especially after the pandemic when the cannabis and gardening industries both flourished.

“If people are stuck at home, what are they going to do? They smoke a joint and go garden,” Chris Hagedorn said. “And that’s pretty much what happened, so the consumer business [of Scotts] saw a huge boost, we did as well.”

Photo by Richard T on Unsplash

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.