By New Frontier Data

Q: I bought stock in a few cannabis companies back in January, and they've been steadily losing value: What gives? How does 2020 look?

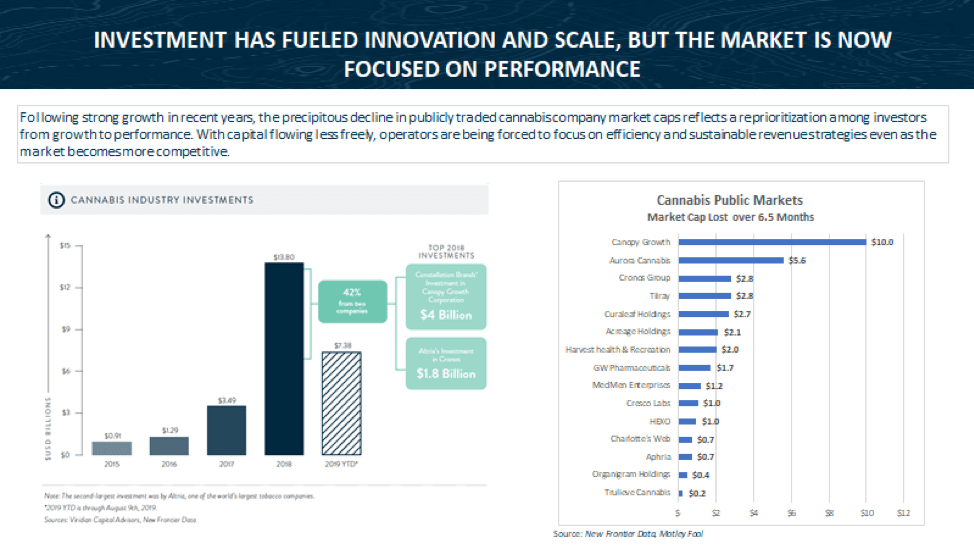

A: In preparing to close out 2019, it can be helpful to look back and reflect on how the market has evolved. It has been a tumultuous couple of years: In October 2018, a landmark year ended as Canada legalized its nationwide adult-use program. That was followed by the passage of the 2018 Farm Bill which federally legalized hemp in the United States for the first time in seven decades. Substantial investments — including Constellation Brand's sizeable stake in Canopy Growth, Altria's investment in Cronos, and the partnership agreement between Novartis and Tilray — prompted widespread speculation and the inflation of stock prices. The cash inflow was utilized to expand both internally and internationally as corporations jockeyed for their positions in a growing and volatile market.

In 2019, the nascent market has continued to expand even as the valuations of many companies have declined. The tensions and trends were due in part to a failure to realize the projected benefits of the previous year's investment. International expansion is a lengthy, long-game process that is played out as the industry wends through an ever-changing series of hoops in order to meet the regulatory requirements of various markets. Perhaps it means receiving a Good Manufacturing Practice (GMP) certification in the European Union, or meeting certain lab-testing standards before products can be made available for sale.

At the same time, individual investors have grown fatigued and wary of the ever-volatile cannabis market.

As New Frontier Data's Senior Economist Beau Whitney observed, "investors are tired of seeing the potential of the market without the results. Investors are also tired of seeing their portfolios decline in value with no apparent end in sight. As a result, they have a substantially more discerning eye when it comes to investing in this space. Whereas previously an investor might have relied more on the potential of the opportunities or ridden on the momentum play in the space, investors are now closely scrutinizing the fundamentals of the companies, and demanding much more due diligence."

A complex and unpredictable regulatory framework also continues to hamper the legal market. In the United States, the vaping crisis — coupled with recent FDA warnings aimed at undercutting health-benefit claims — have also stoked public fears and impacted sales during 2019. In Canada, delays in the availability of new products and limited expansion of retail outlets exacerbated some of the industry's growing pains. Canopy Growth's CEO Mark Zekulin rued how "Ontario represents 40% of Canada's population, yet has one retail cannabis store per 600,000 people," resulting in a self-limiting bottleneck limiting legal cannabis's reach while providing an opportunity for the illicit market to meet excess demand.

Despite an array of issues, the cannabis industry's future is bright and the sector remains profitable. New Frontier Data estimated global cannabis demand to reach approximately $344.4 billion in 2019. Such demand, while hampered by various external factors, is expected to be relatively stable regardless of global market conditions. Whitney commented, "Given that cannabis is still a growth sector, its performance will fare better than other more mature markets during periods of economic weakness." That means that there are still high value investments that can be purchased at a discount for investors who can stomach the volatility.

Regulatory restrictions remain the primary limit on market growth. It is important to remember that the U.S. recreational market is based on 11 states. Dramatic price fluctuations in the MORE Act's wake is symbolic of the potential expansion to be found were there broader legislative action realized. However, the regulatory sword cuts both ways: As has been seen with California's upcoming tax hike, governing bodies have the power to build or break a market at every stage of development.

The future looks green, but 2020 will indeed be a year for more clear-eyed vision on the parts of stakeholders and policy makers alike.

The post Ask Our Experts 12/8/19: Overview of 2019 North American Market appeared first on New Frontier Data.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.