By William Sumner, Hemp Business Journal Contributor

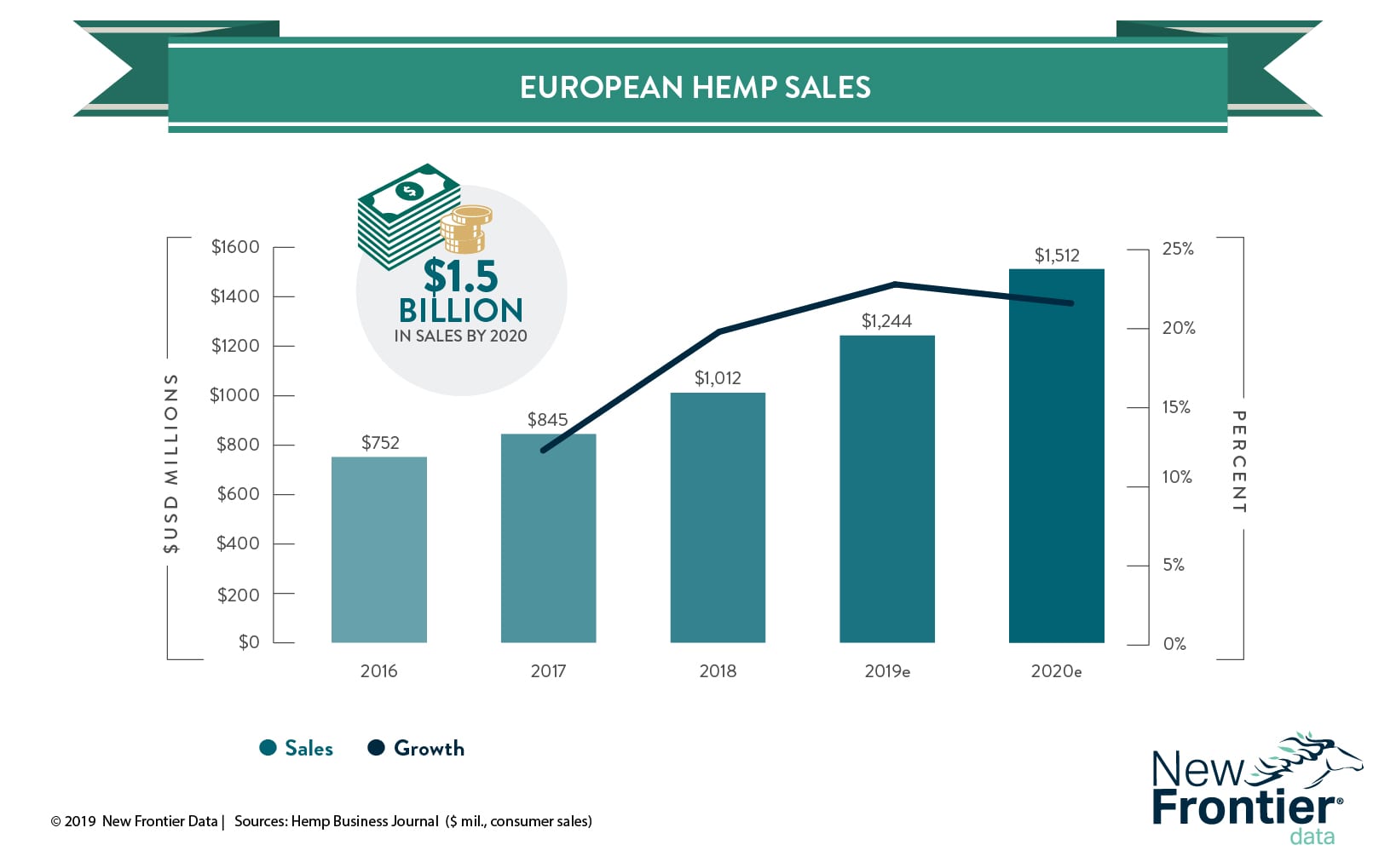

While much has been made about the nascent hemp markets in the United States and Canada, the European market has proven to be enticing on its own: The Hemp Business Journal estimates that by 2020 Europe will see approximately $1.5 billion in sales, whereas the U.S. market is respectively expected to reach $1.2 billion by 2022.

Given that growth potential in the European hemp market, the Hemp Business Journal notes two trends that investors and entrepreneurs ought take note of:

Canadian LPs and the Scramble for Europe

One of the biggest industry trends in recent years has been the influx of licensed cannabis producers from Canada entering the European hemp market. For example, last year Maricann Group MARI announced that it would acquire the Swedish hemp producer Haxxon. Similarly, Aurora Cannabis ACB acquired one of Europe's largest hemp producers, Agropro UAB, as well as the hemp processor and distributor Borela UAB.

Notably, The Green Organic Dutchman TGOD announced in August 2018 that it had signed a definitive agreement to acquire Europe's leading organic hemp-based cannabidiol (CBD) oil product, HemPoland, for CAD$20.4 million (USD$15.6 million), along with a CAD$13.5 million (USD$10.3 million) cash investment for rapid European expansion.

There are two main reasons why Canadian LPs are scrambling to gain ground in Europe's hemp market: The first is that the European hemp market has a lot of room for growth and very few actors operating in that space when compared to the North American market. Instead of trying to compete in a crowded marketplace, Canadian LPs are opting to go for the low-hanging, yet lucrative, fruit.

The second reason is that by establishing a European foothold now, Canadian LPs will be better positioned to transition to cannabis production whenever legalization ever takes hold in the European Union. As the EU's hemp industry continues to grow, expect to see more Canadian LPs start to dabble in the market.

Europe is Hesitant to Embrace CBD

Earlier this year, the European Food Safety Authority (EUFSA) classified CBD as a "novel food" additive, meaning that any food or extract containing CBD will be required to undergo safety evaluations before being sold in the EU. Though the ruling had a chilling effect on the European CBD market, many have been holding out hope that regulators might be convinced to reverse their position, a bet that for now appears more unlikely by the day.

Recently, the German Federal Office of Consumer Protection and Food Safety (BVL) echoed the EUFSA's position, stating that CBD products could not be sold in the country at all unless the product in question undergoes safety evaluations. As one of the most populous and economically prosperous countries in the EU, Germany's stance on CBD has been seen by many as a blow to the European hemp industry.

Should the U.S. Food and Drug Administration (FDA) move to allow CBD as a nutritional substance, circumstances in Europe may change, but barring that, it seems unlikely that the EU will alter its position on CBD any time soon.

William Sumner

William Sumner is a writer for the hemp and cannabis industry. Hailing from Panama City, Florida, William covers various topics such as hemp legislation, investment, and business. William's writing has appeared in publications such as Green Market Report, Civilized, and MJINews. You can follow William on Twitter: @W_Sumner.

The post European Hemp Market Offers Major Obstacles Along with Speculative Rewards appeared first on New Frontier Data.

Image Sourced by Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.