New Home Sales is a huge gauge for the state of the economy. The building of the home, the loans for purchasing, the realtors, the upgrades, the decorating, the new furniture and the economic stimulation goes on. If the US New Home Sales report is up, that’s a good sign for the economy and good for currency. The number and news released at 10:00 AM ET, Monday, April 25, 2016, can create implied volatility in the market, making for a good trade opportunity, regardless if the news is a good or bad reflection of the economy.

Trading Nadex EUR/USD spreads, the strategy used is an Iron Condor. Essentially, it is buying below and selling above the market with the expectation of the market either staying in a range between those points, or making a move and pulling back. The concept of a spread is designating a range of a market to trade and there you have a spread option. It has a floor or bottom of the range and a ceiling or top of the range. The spread can be bought or sold. The advantage of the floor/ceiling concept is capped, defined risk up front. There is no losing past the floor if you’re short or past the ceiling if you’re long. This also applies to profiting. Profits stop at the floor and the ceiling.

Setting up the strategy requires just the right spreads. Entering as early as 9:00 AM ET for 11:00 AM ET expirations, buy a spread below the market but with the ceiling where the market is trading at the time. Concurrently, sell a spread above the market but with the floor where the market is trading at the time. The ceiling of the bought spread should meet the floor of the sold spread. The key for this trade is the profit potential of $30 or more combined between the spreads, therefore approximately $15 per spread.

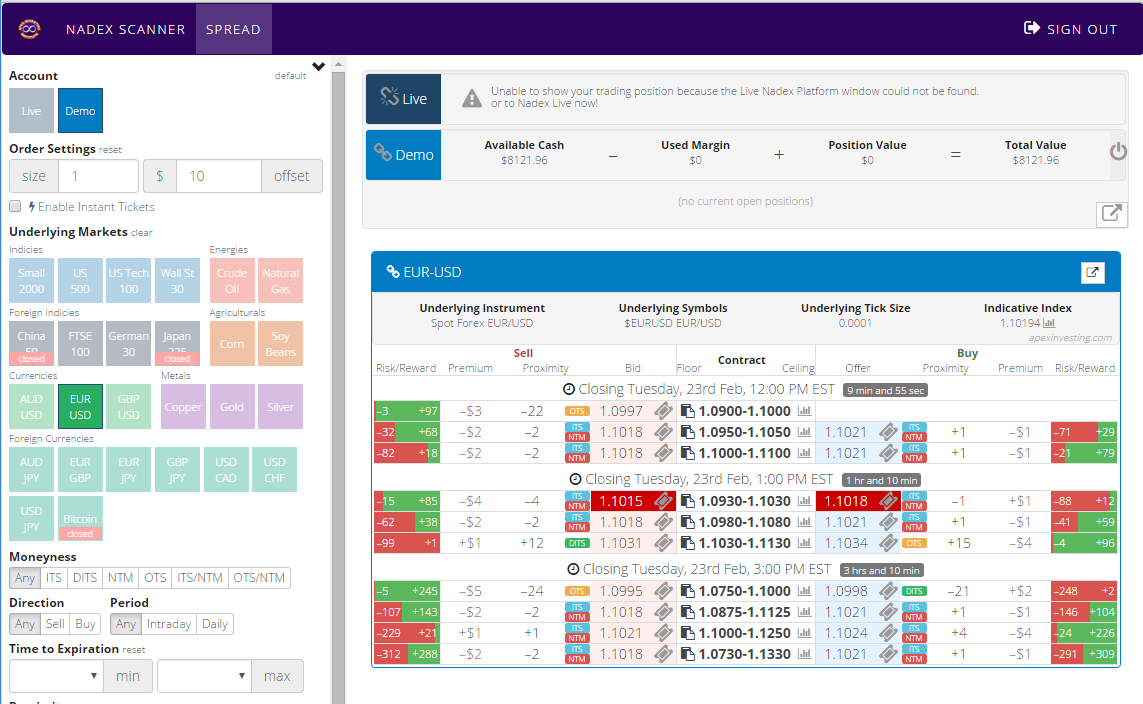

None of that is complicated. In fact, it is easy using the spread scanner available free to all traders at www.apexinvesting.com. Once logged into your Nadex demo or live account, you open the spread scanner and choose your desired market. Now, at a glance, you can see all the required information in one window and find just the right spreads quickly. See the image below for an example of the spread scanner.

To view a larger image click HERE.

When you click the ticket icon, an order ticket opens to enter your information. Then, click submit and the order is immediately entered. Be sure to set up stop limit orders where the market hits the 1:1 risk/reward ratio. For this Iron Condor, those points are approximately where the market hits 60 pips up or down, depending on your exact entry.

For a complete calendar of news events and strategies to trade them, see the news section of www.apexinvesting.com. Apex also provides free education on trading Nadex binaries and spreads as well as futures, forex and CFDs. Nadex is a CFTC regulated US based exchange, and can be traded from 48 different countries.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.