The Richard Ivey School of Business surveys purchasing managers across Canada monthly and produces a level of diffusion index indicating whether industry there is expanding or contracting. Purchasing managers are asked a variety of questions pertaining to business conditions including everything from employment, inventories, new orders, pricing and more. The result of this survey is the Ivey Purchasing Managers Index and the next release is Wednesday, April 6, 2016, at 10:00 AM ET.

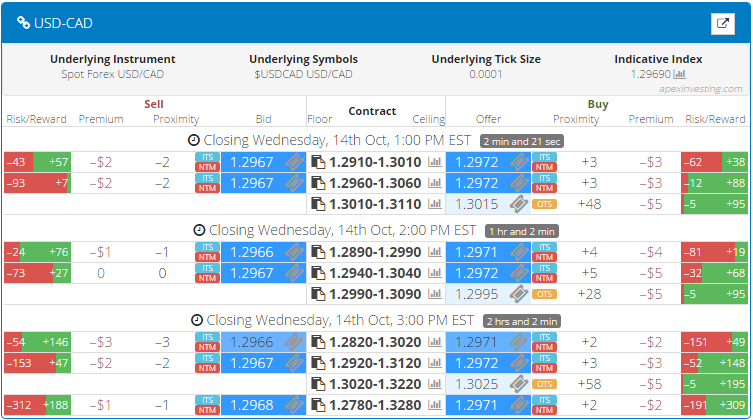

Traders watch this leading economic indicator because purchasing managers have a great insight into the most current views of businesses. Therefore, this news event can be good for trading using Nadex spreads and an Iron Condor strategy. To set that up, simply buy a USD/CAD Nadex spread with the ceiling where the market is trading at the time, and sell a Nadex USD/CAD spread where the floor is trading at the time. Each spread should have a profit potential of $12.50 or more for a combined profit potential of $25. If you want to trade more spreads, you can; simply have the same number of spreads on each side.

Apex Investing recommends this strategy for this news event based on 12 - 24 previous months of market reaction to the released reports. The trade can be entered as early as 10:00 AM ET for 12:00 PM ET expirations. Be sure to place limit take profit orders after you place your trade. The market may move far enough for one side to profit and then pull back and the other side could profit as well. Since you are buying below the market and selling above the market, you want the market to stay where it is until expiration, or make a move and pull back to where it was. With either of those scenarios, you stand to make the greatest profit.

To enter your trade while trading Nadex spreads, you pay the max risk upfront. However, that is not your realistic risk. The realistic risk is based on a 1:1 risk/reward ratio and for this trade, it would be where the market moves up approximately 50 pips or down 50 pips. That is where to exit the trade to manage risk and keep it realistic. You are risking only $25 to make a profit of $25. At settlement, you receive the amount you paid to enter the trade plus any profit made or less any loss incurred.

The ideal spreads for the strategy can be found quickly at a glance on the spread scanner. Once the right spreads are found, simply click the ticket icon, enter your order information and your order is submitted. Everything, including tracking your trade, can be done in the same window.

To view a larger image click HERE.

To access the spread scanner for free, visit www.apexinvesting.com. There you will find free education on how to trade Nadex binaries and spreads as well as futures, forex and CFDs. Nadex is a US based CFTC regulated exchange and can be traded from 48 different countries.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.