In Australia, two reports will be released Thursday, February 4, 2016 at 7:30 PM ET making for a trade opportunity in the evening. The Reserve Bank of Australia meets quarterly and then releases their Monetary Policy Statement. The statement includes their insights into the economic conditions and factors that influence their interest rate decisions. The Australian Bureau of Statistics will also release the Retail Sales, which is the total value of sales at the retail level. Retail sales tells of consumer spending, which is an essential view into the health of the economy.

Together, these reports can move the market and then the market tends to pull back. For this kind of anticipated market move, an Iron Condor strategy, using Nadex spreads can be ideal. To set up the trade, you can enter as early as 7:00 PM ET for 9:00 PM ET expirations. Spreads allow you trade a range of a market, either long or short. They have a ceiling and a floor and you cannot win or lose past those points, which provide capped risk. To enter a spread, you put up the max risk, but upon exit or settlement, you receive that amount back plus or minus your profit or loss, respectively. It is suggested to buy a Nadex AUD/USD spread below the market but with the ceiling where the market is trading at the time, and sell a Nadex AUD/USD spread with the floor where the market is trading at the time.

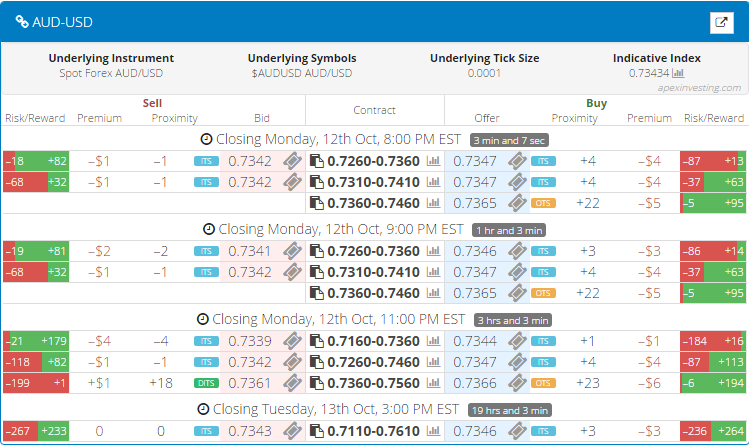

The other requirement is your spreads need to have a profit or reward potential of $30 or more combined between the spreads. Therefore, each spread should have around $15 or more reward potential. You can find spreads with all the right parameters on the spread scanner available with free login credentials at www.apexinvesting.com. You need a Nadex demo or live account and to be logged in there as well. Both website’s membership and accounts take only moments to set up.

To view larger image click HERE.

You can see from the image above that the Risk/Reward columns for the spreads are on the far left if you are selling the spread and the far right if you are buying the spread. The floor and ceiling of the spreads are listed down the middle. To enter, simply click on a ticket icon and you will see all the information needed to enter. At that point, you may notice the risk seems quite high. The Iron Condor strategy collects profit as the market moves and then pulls back to around where it started, or if the market ranges. The market can move in either direction as long as it pulls back. Max profit for this setup is when the spreads expire and the market is right in the middle between the spreads. It’s also important to note here, that it is only $1 less in profit for every pip away the market is from the center at settlement. Another way your trade can profit is if the market makes a move and one side takes profit, then the market pulls back and the other side profits.

Now you may think, but what if the market makes a move and doesn’t pull back? The advantage to the Iron Condor is it gives the market a wide wingspan to move before hitting a break even or even a 1:1 risk reward ratio point. For this trade, depending on your exact reward potential, the market can move 30 pips in either direction and your trade is only at breakeven. If you want to enter stop triggers, then you can set them to trigger at the 1:1 risk reward points, when the market moves up or down 60 pips. You can see now how far the market must move to hit your stop. The profit potential sets the width of your Iron Condor and based on analysis from 12 - 24 months of market reaction to these reports, $30 was found to be ideal for the highest probability setup.

For a full calendar of news events and strategies to trade them go to www.apexinvesting.com. While there, visit the 17,000 strong member forum of real traders helping traders covering all topics regarding day trading, along with free education from Apex Investing. Nadex is a US based CFTC regulated exchange and can be traded from 48 different countries.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.