Consumer spending drives economies and if people aren’t employed, they don't have money to spend. Employment Change for Australia and their Unemployment rate reports are being released Wednesday, January 13, 2016, at 7:30 PM ET. These reports can create implied volatility in the markets and can make for a high probability trade using Nadex spreads. This report comes out in the evening making it convenient for traders who work during the day but want to trade as well. Trading the AUD/USD using Nadex spreads can offer that opportunity. The evening is frequently the time when Australia releases news and the Nadex exchange, listing spreads and binaries, is open for trading at that time.

Nadex spreads allow the trader to trade a portion of the market they are interested in trading. You can buy or sell spreads. A floor and a ceiling mark the portion of the market you are able to trade. Past those points, you won’t win or lose, thus making your risk capped and known upfront. To enter a spread, you pay the total amount of your risk and at exit or settlement that amount is returned to you including your profit, or minus your loss.

The trade strategy used to trade these reports is efficient in capturing the premium generated from implied volatility, which can be built into the price of the spreads. The trick is to enter at the right time when the premium is still present in the prices. As time goes by and the market moves, the premium expires and the price moves. Your position can then collect that premium.

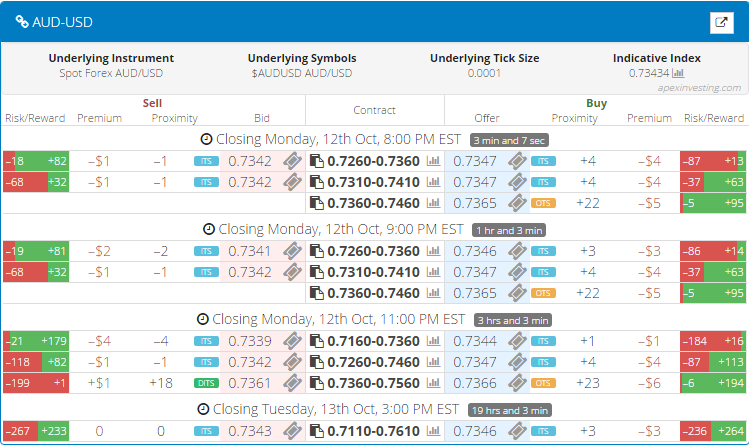

To set up this strategy, you buy a spread below the market, but with the ceiling at market. You also sell a spread above the market, but with the floor at market. You can enter at 6:00 PM ET for 11:00 PM ET expirations. Essentially, you are buying below the market and selling above the market, so you want the market to stay where it is or move and pull back. This strategy is great for ranging markets or ones that will move and then pull back. You also want the trade to have $35 or more in profit potential. Therefore, each spread should have around $17 or more in profit potential or reward potential. To find your spreads at a glance, just open the spread scanner. Below you can see an example of the scanner showing Nadex AUD/USD spreads.

To view larger image click HERE.

If the market makes a move, one side of your trade will profit, leave the other side on though. If the market pulls back, then your other side may profit as well. If the market just stays in a range, then you will also profit. Max profit is when the market pulls back and is between your two spreads at expiration. You bought the lower spread at below market and you sold the upper spread at above market. The market can move up or down 35 pips, you are still break even on the trade. You can put stop limit orders where the market would have moved 70 pips up or down. At those points is where the market will be at a 1:1 risk reward ratio.

To learn more about how to trade spreads on the news and Nadex, go to www.apexinvesting.com. Nadex is a US based exchange regulated by the CFTC and can be traded from 48 different countries.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.