Eurostat is the statistical office of the European Union, providing statistics on the the European Union. On Monday at 5:00 a.m. ET, Eurostat will release the Euro Final CPI and Final Core CPI (Consumer Price Index). The CPI measures the change in the price of goods and services consumers purchased. The Core CPI excludes food, energy, alcohol and tobacco from the numbers. There are two reports for the CPI, Flash and Final. Flash is released first and usually has more impact than the Final.

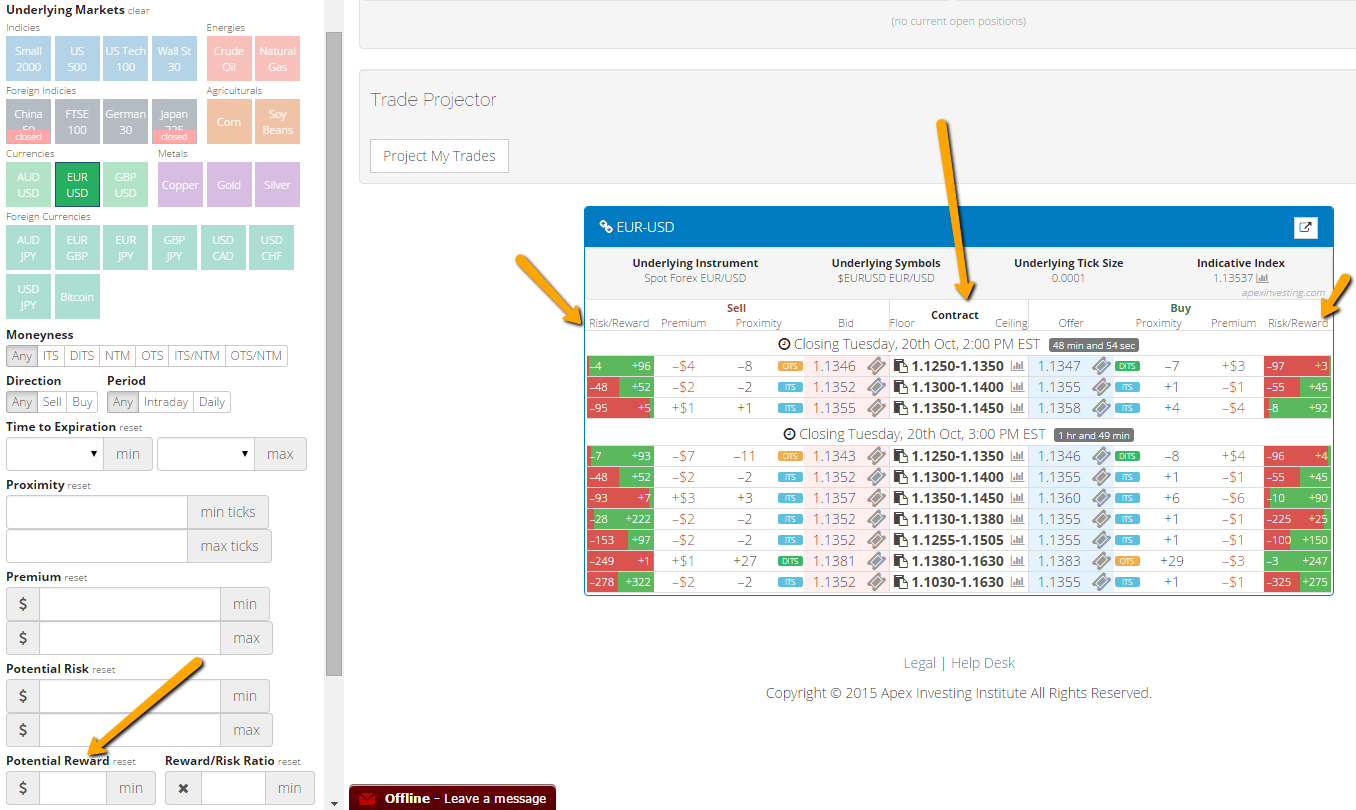

There is still an opportunity to trade the Final report using Nadex EUR/USD Spreads. Since the reports are released so early in the morning, it’s recommended to place the trade in the evening on Sunday at 11:00 p.m. ET. The strategy recommended for this news release is an Iron Condor meant for trading when it is unknown which direction the market will go. To set up this strategy, you will buy a lower spread and sell an upper spread. Be sure to use the spread scanner,which is accessible at www.apexinvesting.com, to find just the right spreads for your trade. Below is an example of the spread scanner displaying Nadex EUR/USD spreads.

To view a larger image click HERE.

You can see the spreads are listed down the center. Spreads have a floor and a ceiling which provides a limit for risk and for reward. You can’t win or lose past the floor or ceiling based on the direction you traded the spread. For this trade, buy a lower spread with the ceiling where the market is trading at the time and sell an upper spread with the floor where the market is trading at the time. Then looking at the risk/reward bars in the spread scanner, be sure that your chosen spreads have a combined reward potential of $35 or more. That would be $15 - $18 or more reward potential per spread.

When the news is released, based on previous reaction to the reports, the market tends to react and then pull back. This could allow for one side of your trade to win and then the other depending on how far the market pulls back. Max profit would be if the market was right between your spreads at expiration. The beauty of the Iron Condor is it’s wide range allowing ample room for the market to move while still maintaining a 1:1 risk reward ratio. For this trade, depending on your entries, the market could move 70 pips up or down from the time of entry and your trade will still have a 1:1 risk reward ratio. If the market moves 35 pips up or down, then this is the breakeven point. The market remaining in a range or moving and pulling back to where it started will create a profit.

Nadex spreads and binaries can be traded from 49 different countries. A US based exchange, Nadex is regulated by the CFTC. You can learn more on how to trade the news and trade strategies at www.apexinvesting.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.