Good Morning Everyone!

Yesterday the S&P made history by falling 4% in a single trading day with the VIX closing the same day under 30. Remember, tough times don’t last but tough investors do.

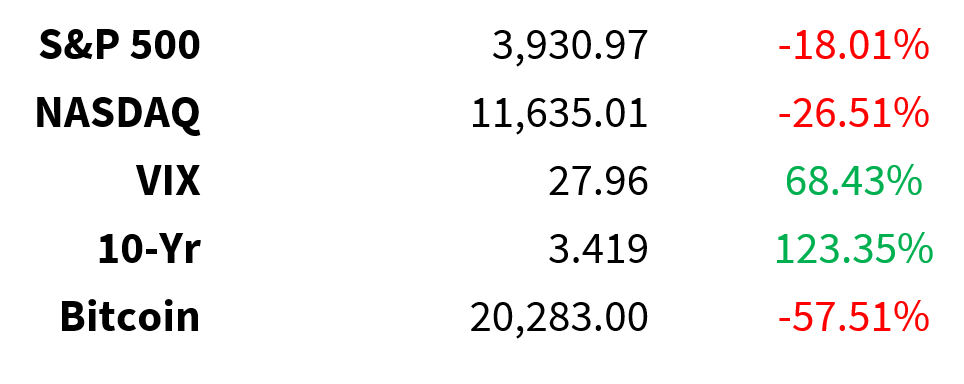

Prices as of 4 pm EST, 9/13/22; % YTD

MARKET UPDATE

QQQ QQQ had their worst day since March 2020 yesterday but in reality, the market just gave back recent gains

-

Yesterday’s move brings us back to Tuesday after the long weekend levels (no panic)

-

Volumes were slightly higher than the 20-day moving average

10yr 3.4%

U.S. PPI decreased 0.1% m-o-m to 8.7%

-

Numbers are in-line with expectations

-

No impact on yields this morning

US$ 109

C$ 75.8

VIX 27

Crude 87 flat

-

API weekly numbers for Crude and product inventories were mixed

-

Biden administration leaked that they would start to buy crude for the strategic reserves at under $80

-

Ongoing discussions in Europe on the market structure for gas and power windfall profit tax

-

IEA reduced it’s 2022 global demand outlook by 110,000 b/d

China

-

The Beijing government announced on Monday that employees and students must show a negative test taken within the previous 48 hours to return to work and school on Tuesday after the three-day Mid-Autumn Festival holiday.

-

That led to chaos on Tuesday morning when commuters found subway gates would not open because they could not verify their Covid-19 tests.

-

Reuters stating that Moderna CEO is talking with the Chinese government to supply vaccine to the country

Earnings: None

CRYPTO UPDATE

Crypto dominance

-

Since June:

-

Bitcoin BTC/USD dominance down to 39.1% from 47.5%

-

Ethereum ETH/USD dominance up to 20.5% from 16%

-

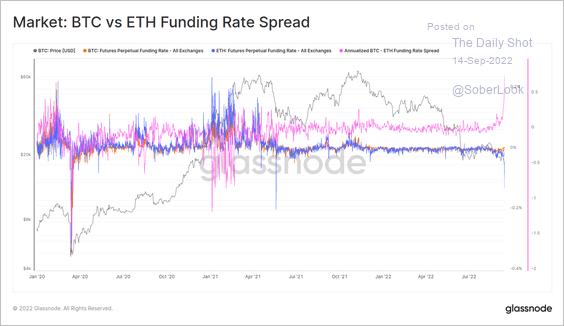

BTC - ETH perpetual funding rate spread

-

Near all-time high

-

Traders heavily short ETH vs BTC

-

Hedging ahead of Merge

Source: DailyShot/Glassnode

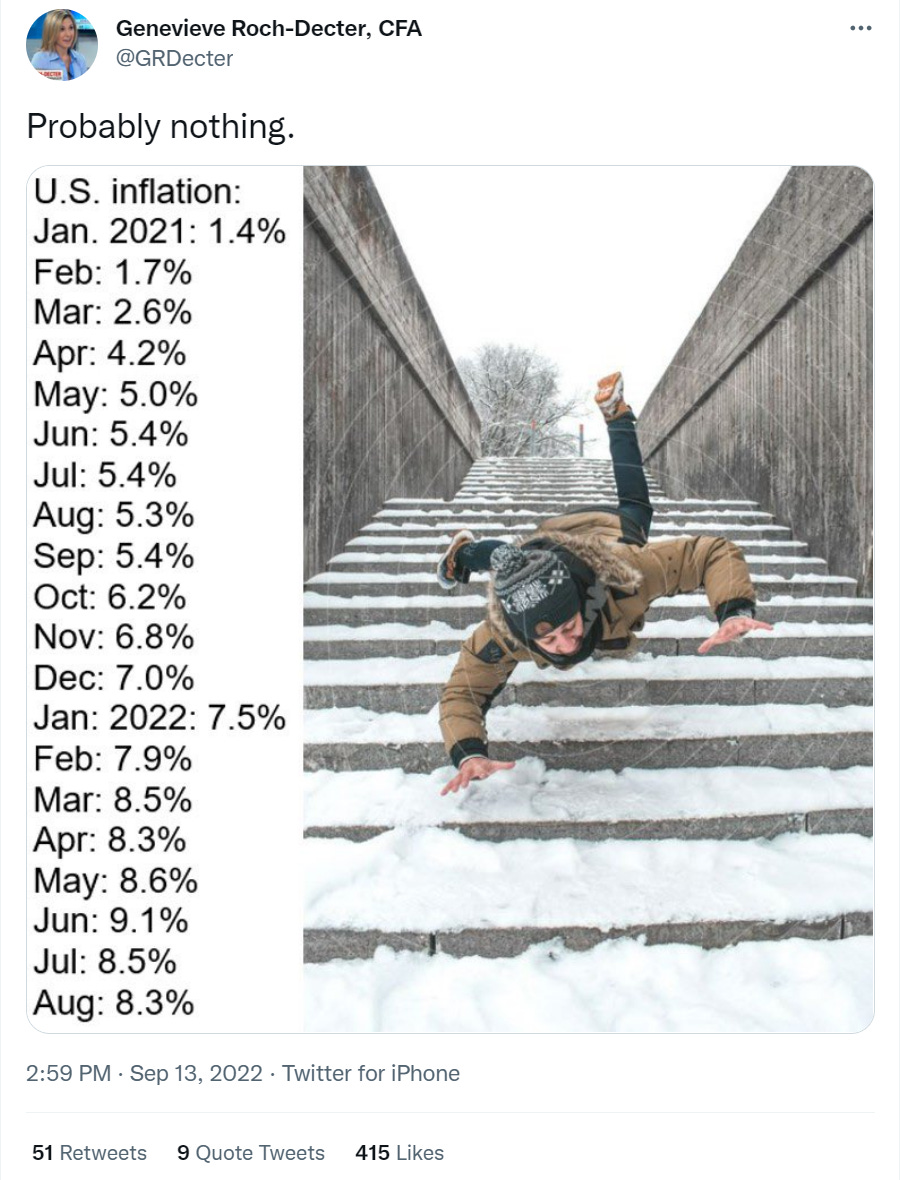

MEME OF THE DAY

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.