In the last three months, 8 analysts have published ratings on Fiverr Intl FVRR, offering a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 0 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 0 | 3 | 0 | 0 |

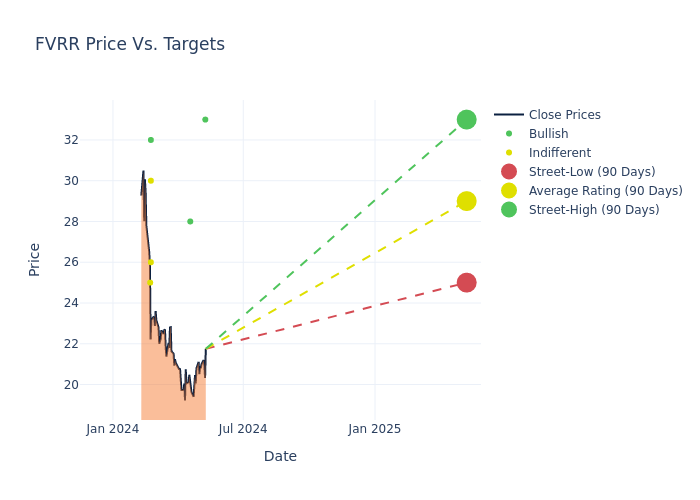

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $30.88, along with a high estimate of $40.00 and a low estimate of $25.00. A decline of 8.29% from the prior average price target is evident in the current average.

Deciphering Analyst Ratings: An In-Depth Analysis

The analysis of recent analyst actions sheds light on the perception of Fiverr Intl by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Bernie McTernan | Needham | Maintains | Buy | $33.00 | - |

| Marvin Fong | BTIG | Lowers | Buy | $28.00 | $30.00 |

| Doug Anmuth | JP Morgan | Lowers | Neutral | $30.00 | $35.00 |

| Ronald Josey | Citigroup | Lowers | Buy | $32.00 | $37.00 |

| Brad Erickson | RBC Capital | Lowers | Sector Perform | $26.00 | $30.00 |

| Bernie McTernan | Needham | Lowers | Buy | $33.00 | $40.00 |

| Matt Farrell | Piper Sandler | Lowers | Neutral | $25.00 | $30.00 |

| Bernie McTernan | Needham | Maintains | Buy | $40.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Fiverr Intl. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Fiverr Intl compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Fiverr Intl's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Fiverr Intl analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Fiverr Intl

Fiverr International Ltd is involved in buying and selling digital services in the same fashion as physical goods on an e-commerce platform. It is set out to design a digital marketplace that is built with a comprehensive SKU-like services catalog and a search, finds, and order process that mirrors a typical e-commerce transaction. The service offerings of the company include Graphics and Design, Digital Marketing, Wiring and Translation, and Video and Animation among others.

Financial Milestones: Fiverr Intl's Journey

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Fiverr Intl's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 10.07%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Fiverr Intl's net margin is impressive, surpassing industry averages. With a net margin of 5.14%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Fiverr Intl's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.39%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Fiverr Intl's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.46%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Fiverr Intl's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.3, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.