Throughout the last three months, 11 analysts have evaluated Deckers Outdoor DECK, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 7 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 3 | 0 | 0 |

| 2M Ago | 0 | 3 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

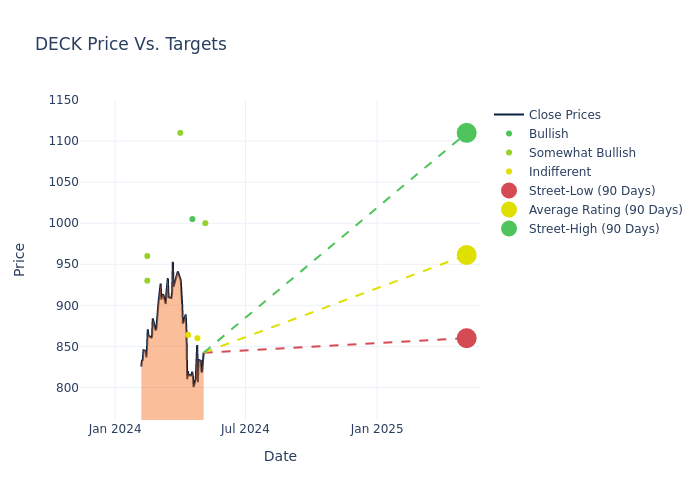

The 12-month price targets, analyzed by analysts, offer insights with an average target of $963.0, a high estimate of $1110.00, and a low estimate of $860.00. Marking an increase of 4.77%, the current average surpasses the previous average price target of $919.17.

Investigating Analyst Ratings: An Elaborate Study

The perception of Deckers Outdoor by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tom Nikic | Wedbush | Maintains | Outperform | $1000.00 | - |

| Christopher Nardone | B of A Securities | Lowers | Neutral | $860.00 | $875.00 |

| John Kernan | TD Cowen | Raises | Buy | $1005.00 | $1000.00 |

| Joseph Civello | Truist Securities | Maintains | Hold | $864.00 | $864.00 |

| Tom Nikic | Wedbush | Maintains | Outperform | $1000.00 | - |

| Joseph Civello | Truist Securities | Lowers | Hold | $864.00 | $983.00 |

| Adrienne Yih | Barclays | Announces | Overweight | $1110.00 | - |

| Tom Nikic | Wedbush | Raises | Outperform | $1000.00 | $895.00 |

| John Kernan | TD Cowen | Raises | Outperform | $1000.00 | $898.00 |

| JESALYN Wong | Evercore ISI Group | Announces | Outperform | $960.00 | - |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $930.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Deckers Outdoor. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Deckers Outdoor compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Deckers Outdoor's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Deckers Outdoor analyst ratings.

Unveiling the Story Behind Deckers Outdoor

Deckers Outdoor Corp designs and sells casual and performance footwear, apparel, and accessories. Primary brands include UGG, Teva, and Sanuk. The company distributes Most of its products through its wholesale business, but it also has a substantial direct-to-consumer business with its company-owned retail stores and websites. Most sales are in the United States, although the company also has retail stores and distributors throughout Europe, Asia, Canada, and Latin America. Deckers sources its products from independent manufacturers primarily in Asia.

A Deep Dive into Deckers Outdoor's Financials

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Positive Revenue Trend: Examining Deckers Outdoor's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 15.95% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Deckers Outdoor's net margin excels beyond industry benchmarks, reaching 24.99%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Deckers Outdoor's ROE excels beyond industry benchmarks, reaching 20.0%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Deckers Outdoor's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 12.59% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.13.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.