18 analysts have shared their evaluations of Marathon Oil MRO during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 7 | 6 | 5 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 4 | 1 | 0 | 0 |

| 2M Ago | 3 | 2 | 4 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

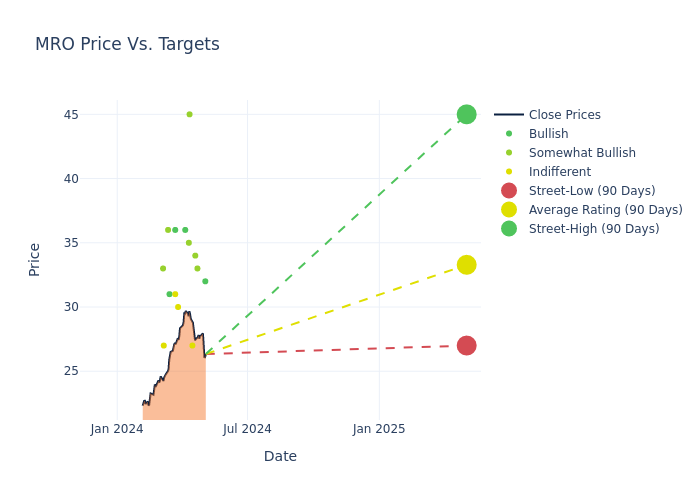

Analysts have set 12-month price targets for Marathon Oil, revealing an average target of $32.83, a high estimate of $45.00, and a low estimate of $26.00. This current average reflects an increase of 6.9% from the previous average price target of $30.71.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Marathon Oil by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Subash Chandra | Benchmark | Maintains | Buy | $32.00 | - |

| Subash Chandra | Benchmark | Maintains | Buy | $32.00 | - |

| Biju Perincheril | Susquehanna | Maintains | Positive | $33.00 | - |

| Mark Lear | Piper Sandler | Raises | Overweight | $34.00 | $32.00 |

| Devin McDermott | Morgan Stanley | Raises | Equal-Weight | $27.00 | $26.00 |

| Paul Cheng | Scotiabank | Raises | Sector Outperform | $45.00 | $35.00 |

| Betty Jiang | Barclays | Announces | Overweight | $35.00 | - |

| Neal Dingmann | Truist Securities | Raises | Buy | $36.00 | $35.00 |

| Devin McDermott | Morgan Stanley | Raises | Equal-Weight | $26.00 | $24.00 |

| Neil Mehta | Goldman Sachs | Raises | Neutral | $30.00 | $26.50 |

| Nitin Kumar | Mizuho | Raises | Neutral | $31.00 | $28.00 |

| Derrick Whitfield | Stifel | Lowers | Buy | $36.00 | $39.00 |

| Bill Selesky | Argus Research | Announces | Buy | $31.00 | - |

| Subash Chandra | Benchmark | Raises | Buy | $32.00 | $25.00 |

| Roger Read | Wells Fargo | Raises | Overweight | $36.00 | $32.00 |

| Josh Silverstein | UBS | Lowers | Neutral | $27.00 | $28.00 |

| Scott Hanold | RBC Capital | Maintains | Outperform | $33.00 | - |

| Neal Dingmann | Truist Securities | Lowers | Buy | $35.00 | $38.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Marathon Oil. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Marathon Oil compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Marathon Oil's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Marathon Oil's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Marathon Oil analyst ratings.

Get to Know Marathon Oil Better

Marathon is an independent exploration and production company primarily focusing on unconventional resources in the United States. At the end of 2022, the company reported net proved reserves of 1.3 billion barrels of oil equivalent. Net production averaged 343 thousand barrels of oil equivalent per day in 2022 at a ratio of 70% oil and NGLs and 30% natural gas.

Marathon Oil: Financial Performance Dissected

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Negative Revenue Trend: Examining Marathon Oil's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -1.12% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 25.05%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Marathon Oil's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 3.54%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Marathon Oil's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 2.01%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Marathon Oil's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.48.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.