Throughout the last three months, 5 analysts have evaluated Leggett & Platt LEG, offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 3 | 2 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 1 | 0 |

| 2M Ago | 0 | 0 | 1 | 1 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

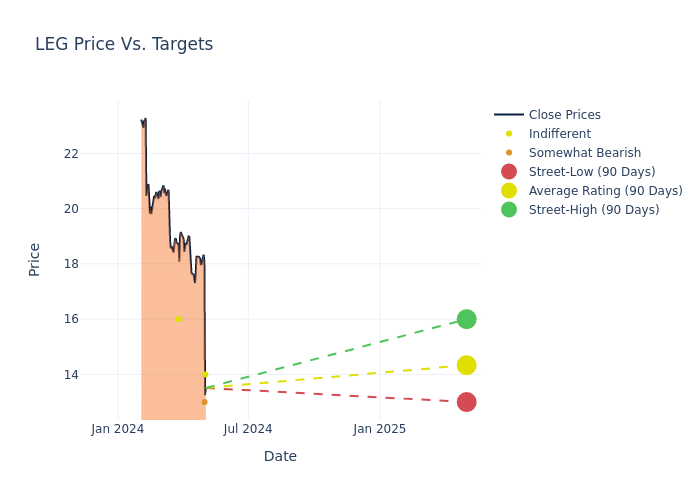

Analysts have set 12-month price targets for Leggett & Platt, revealing an average target of $15.4, a high estimate of $18.00, and a low estimate of $13.00. A decline of 19.79% from the prior average price target is evident in the current average.

Analyzing Analyst Ratings: A Detailed Breakdown

The analysis of recent analyst actions sheds light on the perception of Leggett & Platt by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Susan Maklari | Goldman Sachs | Lowers | Neutral | $14.00 | $20.00 |

| Peter Keith | Piper Sandler | Lowers | Underweight | $13.00 | $16.00 |

| Keith Hughes | Truist Securities | Lowers | Hold | $16.00 | $18.00 |

| Peter Keith | Piper Sandler | Lowers | Underweight | $16.00 | $18.00 |

| Keith Hughes | Truist Securities | Lowers | Hold | $18.00 | $24.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Leggett & Platt. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Leggett & Platt compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Leggett & Platt's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Leggett & Platt analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Leggett & Platt Better

Leggett & Platt Inc designs and produces engineered components and products found in homes and automobiles. It operates its business through three segments namely Bedding Products, Specialized Products, and Furniture, Flooring, and Textile Products. It generates the majority of its revenue from Bedding Products. Serving a broad suite of customers around the world, Leggett & Platt's products include bedding components, automotive seat support, and lumbar systems, specialty bedding foam and private label finished mattresses, components for home furniture, and work furniture, flooring underlayment, adjustable beds, and various other products.

Breaking Down Leggett & Platt's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Challenges: Leggett & Platt's revenue growth over 3 months faced difficulties. As of 31 March, 2024, the company experienced a decline of approximately -1.63%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Leggett & Platt's net margin is impressive, surpassing industry averages. With a net margin of 2.88%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Leggett & Platt's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.41%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Leggett & Platt's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.68%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.78.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.