Throughout the last three months, 15 analysts have evaluated Devon Energy DVN, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 7 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 4 | 4 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

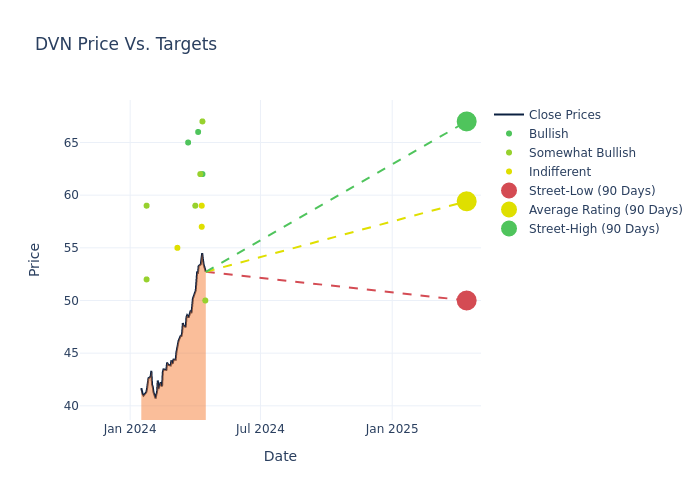

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $59.47, along with a high estimate of $75.00 and a low estimate of $49.00. This current average reflects an increase of 4.06% from the previous average price target of $57.15.

Interpreting Analyst Ratings: A Closer Look

A clear picture of Devon Energy's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Devin McDermott | Morgan Stanley | Raises | Overweight | $50.00 | $49.00 |

| Scott Gruber | Citigroup | Raises | Buy | $62.00 | $55.00 |

| Paul Cheng | Scotiabank | Raises | Sector Outperform | $67.00 | $53.00 |

| Josh Silverstein | UBS | Raises | Neutral | $57.00 | $48.00 |

| Betty Jiang | Barclays | Announces | Equal-Weight | $59.00 | - |

| Arun Jayaram | JP Morgan | Raises | Overweight | $62.00 | $57.00 |

| Neal Dingmann | Truist Securities | Lowers | Buy | $66.00 | $69.00 |

| Roger Read | Wells Fargo | Raises | Overweight | $59.00 | $46.00 |

| Devin McDermott | Morgan Stanley | Raises | Overweight | $49.00 | $48.00 |

| Derrick Whitfield | Stifel | Lowers | Buy | $65.00 | $75.00 |

| Scott Gruber | Citigroup | Raises | Buy | $55.00 | $52.00 |

| Scott Hanold | RBC Capital | Maintains | Sector Perform | $55.00 | - |

| John Freeman | Raymond James | Lowers | Outperform | $52.00 | $53.00 |

| Mark Lear | Piper Sandler | Lowers | Overweight | $59.00 | $61.00 |

| Derrick Whitfield | Stifel | Lowers | Buy | $75.00 | $77.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Devon Energy. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Devon Energy compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Devon Energy's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Devon Energy's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Devon Energy analyst ratings.

About Devon Energy

Devon Energy, based in Oklahoma City, is one of the largest independent exploration and production companies in North America. The firm's asset base is spread throughout onshore North America and includes exposure to the Delaware, STACK, Eagle Ford, Powder River Basin, and Bakken plays. At year-end 2023, net production totaled roughly 658 thousand boe/d, of which oil and natural gas liquids made up roughly three-quarters of production, with natural gas accounting for the remainder.

Financial Insights: Devon Energy

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Decline in Revenue: Over the 3 months period, Devon Energy faced challenges, resulting in a decline of approximately -3.58% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Net Margin: Devon Energy's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 27.79%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Devon Energy's ROE stands out, surpassing industry averages. With an impressive ROE of 9.72%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 4.73%, the company showcases effective utilization of assets.

Debt Management: Devon Energy's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.53, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.