In the last three months, 7 analysts have published ratings on Kohl's KSS, offering a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 5 | 0 | 1 |

| Last 30D | 0 | 1 | 2 | 0 | 1 |

| 1M Ago | 0 | 0 | 3 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

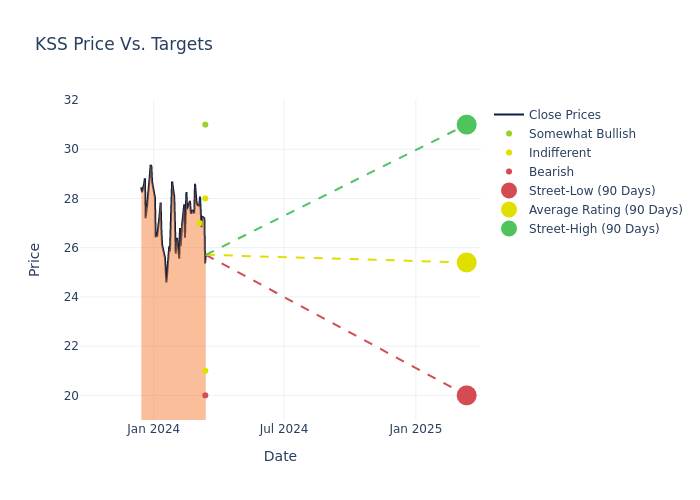

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $25.29, a high estimate of $31.00, and a low estimate of $20.00. Observing a 8.08% increase, the current average has risen from the previous average price target of $23.40.

Interpreting Analyst Ratings: A Closer Look

The standing of Kohl's among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Oliver Chen | TD Cowen | Raises | Outperform | $31.00 | $28.00 |

| Matthew Boss | JP Morgan | Raises | Neutral | $21.00 | $20.00 |

| Brooke Roach | Goldman Sachs | Maintains | Sell | $20.00 | $20.00 |

| Dana Telsey | Telsey Advisory Group | Raises | Market Perform | $28.00 | $25.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Market Perform | $25.00 | - |

| Dana Telsey | Telsey Advisory Group | Maintains | Market Perform | $25.00 | - |

| Paul Lejuez | Citigroup | Raises | Neutral | $27.00 | $24.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Kohl's. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Kohl's compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Kohl's's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Kohl's's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Kohl's analyst ratings.

About Kohl's

Kohl's operates about 1,170 department stores in 49 states that sell moderately priced private-label and national brand clothing, shoes, accessories, cosmetics, and home furnishings. Most of these stores are in strip centers. Kohl's also operates a large digital sales business. Women's apparel is Kohl's largest category, having generated 27% of its 2022 sales. The retailer, headquartered in Menomonee Falls, Wisconsin, opened its first department store in 1962.

Financial Insights: Kohl's

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Negative Revenue Trend: Examining Kohl's's financials over 3 months reveals challenges. As of 31 October, 2023, the company experienced a decline of approximately -5.21% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Kohl's's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 1.46%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Kohl's's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.58% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Kohl's's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.39%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 2.15, Kohl's adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.