In early September Prime Minister Shinzō Abe announced that he would be leaving office after nearly eight years, having significantly altered Japan’s economic policies. When Abe took the reins in December 2012, the economy was beset by three intertwined problems:

- Large annual budget deficits of around 6-8% of GDP since the mid-1990s

- Persistent deflation, which made reducing debt ratios nearly impossible

- Weak economic growth since Japan’s equity and real estate bubbles popped in the early 1990s

Abe sought to address these problems with his “three arrows” initiative of easy monetary policy, tight fiscal policy, and structural reform. Over the past eight years Abe’s policies have had some success. For starters, nominal GDP had its first sustained period of growth since the mid-1990s (Figure 1), lasting until late 2019 when a second increase in the value added tax (VAT) and the pandemic intervened.

Figure 1: Nominal GDP growth is essential to bringing debt under control.

Tightening Fiscal Policy

Prior to Abe taking office at the end of 2012, Japan ran enormous budget deficits since the mid-1990s. Japan’s public debt rose from 62% of GDP in 1992 to 201% by the beginning of 2013. Japan’s government spending as a percentage of GDP was not particularly high by the standards of most developed countries but its tax revenues were extremely low. Abe addressed the low level of tax revenues through two increases in the value added tax: the first, from 5% to 8% and the second, from 8% to 10%. This and other revenue measures, along with improved economic growth, reduced Japan’s pre-Abe budget deficit from the 6-8% of GDP to just 2.8% by 2019 (Figure 2).

Figure 2: Stronger economic growth and a higher value added tax shrank the deficit

Japan’s debt ratios continued to rise during Abe’s first three years in power, with public debt hitting 219% of GDP by the second quarter of 2016. By the end of the first quarter of 2020, the most recent period for which we have data, Japan’s public debt was 218% of GDP, slightly below its peak but, importantly, no longer growing. Meanwhile, Japan’s household and corporate debt levels have been stable under Abe at around 60% and 105% of GDP, respectively (Figure 3).

Figure 3: After three years of Abenomics, debt ratios stabilized

As a result of the pandemic, Japan’s budget deficit and debt ratios are rising once again in 2020. So far, Japan has allocated the equivalent of 7% of GDP to boost the economy amid the pandemic and has extended loans to corporations and households valued at more than 10% of GDP. As such, Japan’s budget deficit for the fiscal year ending in March 2021 will probably fall in the 12-22% of GDP range, and possibly more. This, however, hardly makes Japan unique as similar deficits will occur in the United States and in much of Western Europe (Figure 4).

Figure 4: Japan’s fiscal measures are large but by no means exceptional

Easier Monetary Policy

Abenomics’s ultimate objective was to improve the Japanese economy. Tighter fiscal policy, while necessary for controlling budget deficits, is antithetical to that goal. Essentially, tighter fiscal policy could potentially have derailed growth had it not been for much easier monetary policy.

When Abe took office in 2012, the Bank of Japan’s (BoJ) monetary policy was unexceptional. Like the Federal Reserve (Fed), it had rates at zero and had dabbled in quantitative easing (QE). The main difference with the Fed was one of timing: the BoJ’s rate had hit zero a decade before that of the Fed, and it had conducted some QE between 2000 and 2006 and again between 2010 and 2012 when the Fed was just getting started on its own asset purchases. But at 30% of GDP, the BoJ’s balance sheet wasn’t particularly large. It was about the same as the ECB’s and about 1.5x that of the Fed relative to the size of their respective economies.

In order to offset the fiscal consolidation, the BoJ opted for a QE of unprecedented size and depth that dwarfed similar measures in Europe and North America. The BoJ took its balance sheet from 30% of GDP to over 100% of GDP prior to the pandemic. Now its surpassing 125% of GDP (Figure 5).

Figure 5: B0J undertook an unprecedented QE to offset tighter fiscal policy and end deflation.

Moreover, the BoJ didn’t simply buy government debt. In a preview of what the Fed and the ECB would do during the pandemic, the BoJ was also buying corporate debt as early as 2014. It even purchased equities via exchange traded funds (ETFs), something the BoJ’s counterparts haven’t done and deny are planning to do so.

In addition to the QE measures, the BoJ also conducted yield curve targeting, essentially setting caps on the yields of various maturities of government bonds. Finally, like the ECB but unlike the Fed, it also experimented with negative interest rates, setting its deposit rate at -10 basis points (bps) as of January 29, 2016.

So, have these measures worked? On balance it’s difficult to say. Looking at Japan’s nominal GDP, it looks like a success. Nominal GDP expanded from early 2013 until mid-2019 which is essential for controlling debt ratios since nominal GDP is the denominator in the calculation of those ratios. Real GDP, meaning after inflation, tells a more nuanced story. Judging from the graph of real GDP (Figure 6), it’s difficult to point to any acceleration in Japan’s after-inflation pace of economic growth.

Figure 6: QE did not bring about any obvious acceleration in Japan’s real rate of growth

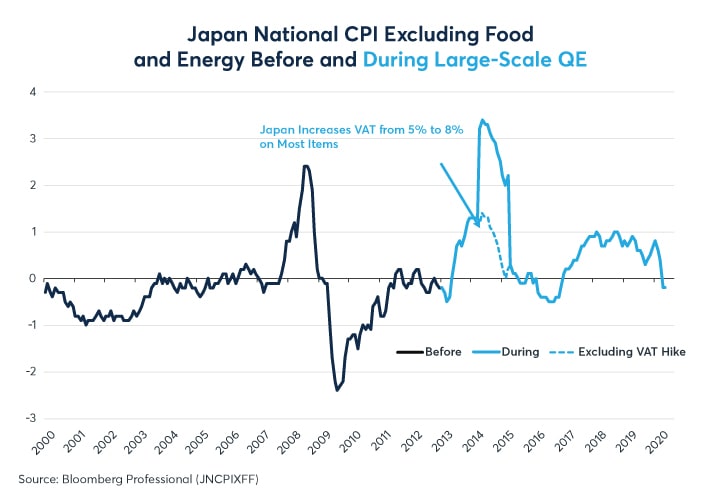

While QE did not give any obvious boost to Japan’s real rate of growth, it did halt persistent deflation with the help of a depreciation in the trade weighted value of the Japanese yen between early 2013 and early 2016. Paradoxically, the BoJ’s resorting to negative rates did not cause the yen to fall further. Rather, in the four-and-a-half years since the BoJ instituted negative deposit rates, the yen has appreciated somewhat (Figure 7). In the year after the decision to go to negative rates, the yen began to rise and inflation regressed into deflation before eventually going positive again (Figure 8).

Figure 7: Negative rates did not lead to a weaker yen

Figure 8: Abenomics helped inflation turn positive but it hasn’t stayed consistently above zero

By at least one measure, Abenomics has been a success: Japan’s jobs market improved markedly until the pandemic struck, with the best jobs-to-applicant ratio seen in decades (Figure 9).

Figure 9: Even during the pandemic, Japan’s jobs-to-applicant ratio is still better than it was pre-Abe

Currency Traders Implied View of the JPYUSD exchange rate

With BoJ rates at -10bps and Fed funds in a range from zero to +25bps, one might expect the difference in market rates between Japan and the US would be in the order of 10-35bps, or perhaps about 22.5bps on average. The difference between Japanese and US 3M LIBOR is at the high end of that range and has been in the 30-35bps range. However, the difference in interest rates from the spot JPYUSD and JPYUSD currency futures using CME’s FX Swap Rate Monitor suggests a greater rate differential of around 40-50bps exists in the currency market (Figure 10).

Figure 10: FX swap rates suggest a bigger US-Japan rate differential than LIBOR or central bank rates

Bottom Line

- Pre-pandemic Abenomics shrank Japan’s annual budget deficits and stabilized debt ratios.

- Post-pandemic, Japan will run extremely large budget deficits in the short term.

- Abenomics had some success at turning inflation positive and boosting the jobs market.

- An unprecedented central bank balance sheet expansion facilitated Abenomics’ successes.

- The interest rate differential in the currency market may be greater than what LIBOR and the gap between BoJ and Fed policy rates implies.

To learn more about futures and options, go to Benzinga’s futures and options education resource.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.