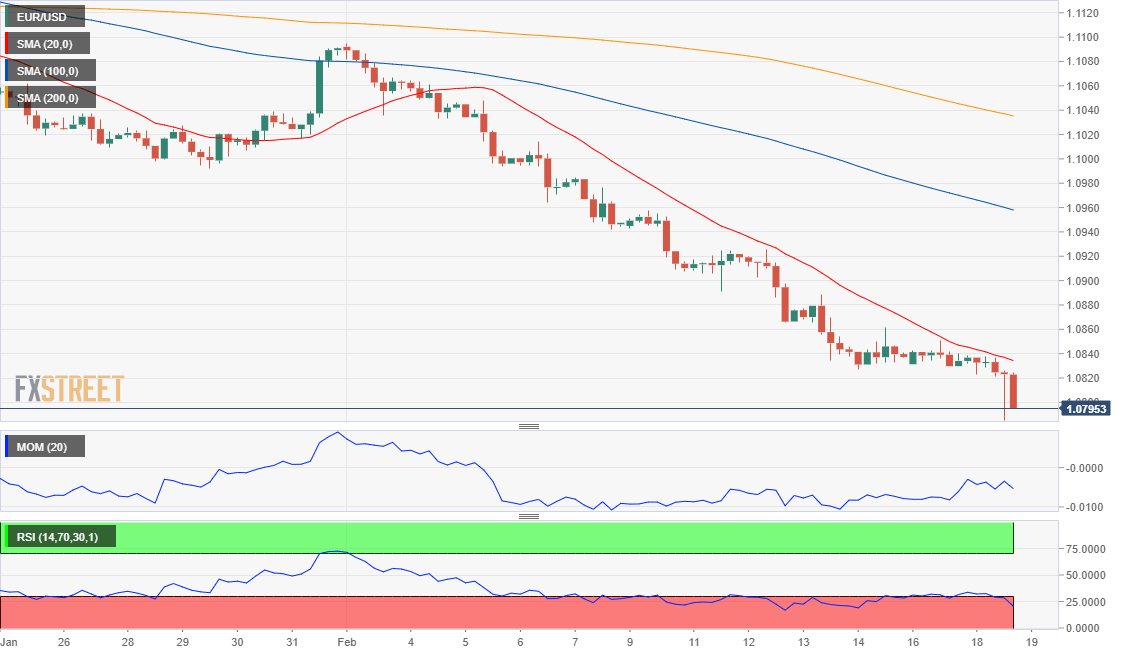

EUR/USD Current Price: 1.0795

- Data imbalances between the US and the EU keep favouring the downside.

- Market players concerned about the possible effects of coronavirus on the economy.

- EUR/USD firmly bearish but extremely oversold, at risk of correcting higher.

The EUR/USD pair fell to 1.0784, its lowest since April 2017, but got to bounce in the American afternoon, ending the day just around the 1.0800 level. Risk aversion took over the financial world during the Asian session, as the coronavirus began to affect companies. Apple issued a warning about upcoming results, related to production issues and the need to close multiple stores in China. Equities plummeted, while gold soared past $1,600 a troy ounce.

The February German ZEW Survey added pressure on the shared currency, as the Economic Sentiment in the country contracted to 8.7 from 26.7. The assessment of the current situation was down to -15.7. For the whole Union, the sentiment was at 10.4, far below the 30 expected. In the US, on the other hand, the February NY Empire State Manufacturing Index, which came in at 12.9, beating the expected 5 and above the previous 4.8. The NAHB Housing Market Index for February, however, resulted in 74, missing the market’s forecast of 75.

Wednesday will bring and ECB non-monetary policy meeting and the December Current Account for the Union. The US will publish the January Producer Price Index and housing data while a couple of Fed members will offer speeches in separated events.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair maintains its extreme oversold conditions, but posted a lower low and a lower high for the day, to close it with modest losses. The bearish trend is firm, although the risk of an upward corrective movement is high. In the short-term, and according to the 4-hour chart, the pair is at risk of falling further, as a 20 SMA keeps capping intraday advances, heading lower far below the larger ones. Technical indicators remain at their daily low within negative levels, suggesting a bottom has not been reached yet.

Support levels: 1.0770 1.0725 1.0690

Resistance levels: 1.0840 1.0885 1.0910

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.