Trading stocks is always a risky proposition, but there are certain circumstances under which it can become even more risky. One of those circumstances has to do with the time of day a trade is made.

The stock market tends to be most volatile right after the opening bell in the morning and right before the closing bell in the afternoon. It’s not surprising that those are the two times during the trading day that see the most volume as well.

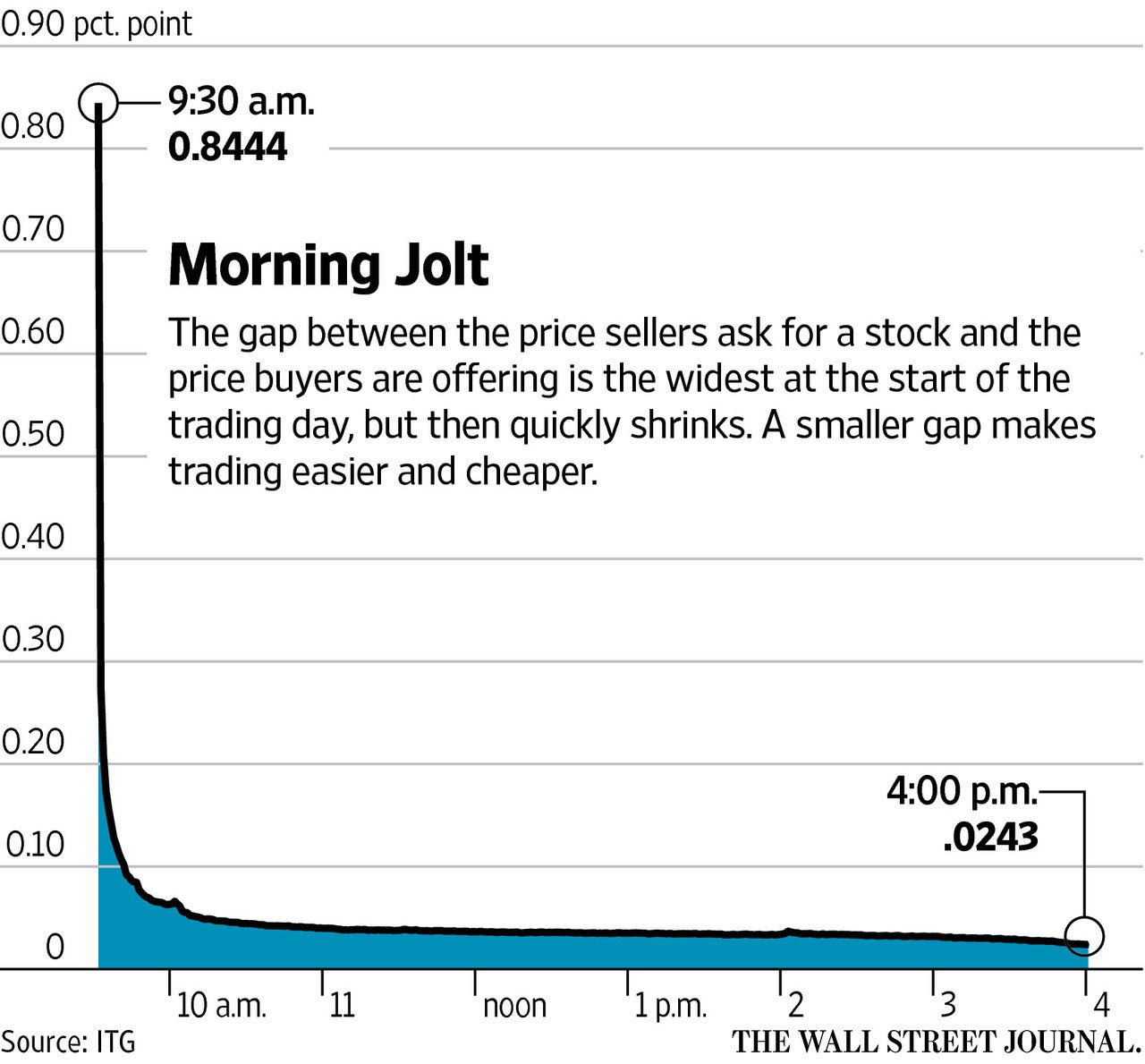

However, there are key differences between trading in the opening minutes of a session and the closing minutes of a session. First, stocks tend to be much cheaper for traders at the close than at the open, at least in terms of the bid-ask spread. The Wall Street Journal graph below shows that the bid-ask spread starts at its highest point right at the open and then quickly shrinks and trends downward throughout the rest of the trading day.

Most “smart money” professional traders recognize that they get better prices when spreads are lower, so they tend to avoid the opening minutes of trading all together. While only about 15 percent of daily stock market volume comes from individual investors, they play a much larger role in the market in the opening minutes.

With much of the institutional trading money on the sidelines, the market tends to have much less liquidity in the opening minutes of the trading day. The lack of liquidity off the open can lead to wild, unpredictable swings in share price within the first few minutes of the trading day.

While it may be tempting to capture these wild swings, professional traders sit on the sidelines for a reason. The stock market can be volatile and unpredictable at any time throughout the day. However, the lack of liquidity off the open often pushes those uncertainties to the next level.

Visit BZTeach for more awesome educational content!

Do you have ideas for articles/interviews you'd like to see more of on Benzinga? Please email feedback@benzinga.com with your best article ideas. One person will be randomly selected to win a $20 Amazon gift card!© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.