The equity markets went through a harrowing time in the first-half of 2022, but Wall Street analysts are confident of an improvement for the remainder of the year.

Macro, Geo Factors Weigh: The broader S&P 500 Index shed 18.2% in the first six months of the year, ending the period at 3,785.38. Thus far, the index traded in a range of 4,818.62 (January 4) and 3,636.87 (June 17).

Investors began 2022 on a nervous note, uneasy over the possibility of the Federal Reserve raising interest rates to contain inflation. To make matters worse, Russia embarked on a war with its smaller neighbor Ukraine in late February. The geopolitical tension sent raw material and energy prices higher, stoking inflationary pressure further.

The central bank was left with no option but to raise the fed funds rate by a quarter percentage point in March, after maintaining it at near-zero levels for nearly two years since the start of the COVID-19 pandemic.

Since then, the Fed has raised rates by 50 basis points at the May meeting and a more aggressive 75 basis points at the June meeting. By virtue of these hikes, the fed funds rate now stands at 1-1/2% to 1-3/4%. More importantly, with inflation not showing signs of cooling, the central bank has signaled that more aggressive rates could follow.

Not everyone approves of the Fed's hawkish approach. A few economists and analysts have voiced concerns about the higher rates stifling economic growth and portending the risk of a protracted recession.

Related Link: Billionaire Ray Dalio Warns Of Stagflation, Calls Fed 'Naïve And Inconsistent' For Raising Interest Rates

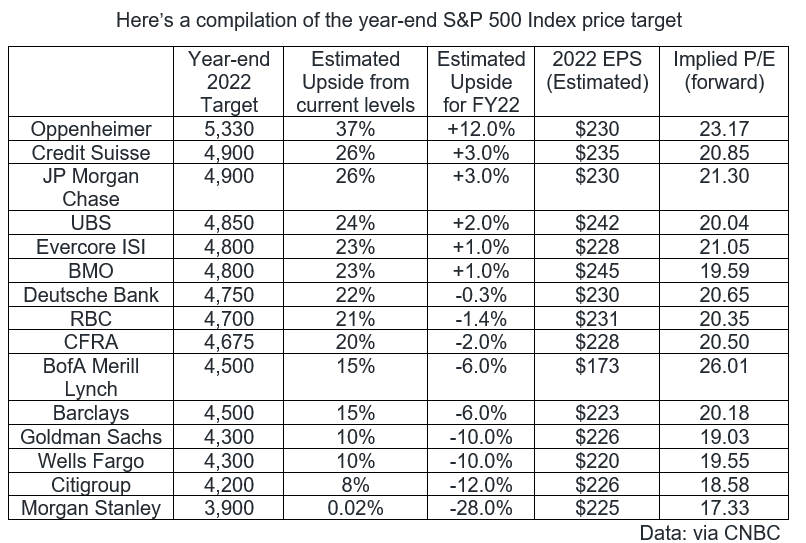

Analysts Expect Reversal: Wall Street firms expect the S&P 500 Index to bounce back from the lows. But only a few of them are of the view the index will end the year in the green.

The EPS for the S&P 500 is calculated by aggregating the EPS estimates of all the constituent companies.

Benzinga's Take: The market could be positioning for a rebound after two quarters of underperformance. A lot of that will hinge on inflation's trajectory, which in turn will determine the Fed's monetary policy stance. An immediate data point on inflation is due this week, with the Labor Department scheduled to release the consumer price inflation report for June on Wednesday.

If the corporate reporting season that kick-starts in the coming week produces positive tidings, it could be an added incentive for investors to hold on to their stocks.

The SPDR S&P 500 ETF Trust SPY ended Friday's session down 0.08% at $388.67, according to Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.