Existing Home Sales month over month will be released Thursday at 10 a.m. EDT.

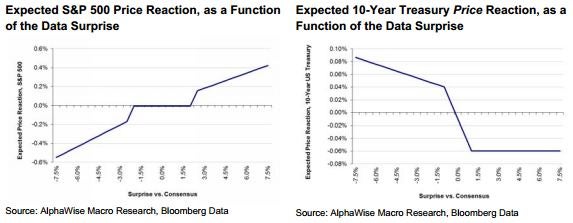

Morgan Stanley MS believes the readers of its report should short 10-year U.S. Treasuries and long the S&P 500. The bank uses a proprietary Real-Time Tracker to predict what Existing Home Sales will be. The RTT estimate is for +2.6 percent or 5.17 million versus consensus expectations of -0.4 percent or 5.02 million.

(Click to Enlarge)

The reasoning for the firm's trade view:

"In the event of a data surprise (of 2% or more), our tick data analysis (5-year history) suggests a 29-bp average price reaction for the S&P 500 and an 8-bp average price reaction (or 1-bp average yield reaction) in 10-year US Treasuries".

(Click to Enlarge)

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.