In the latest quarter, 6 analysts provided ratings for United Parcel Service UPS, showcasing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 4 | 0 | 0 |

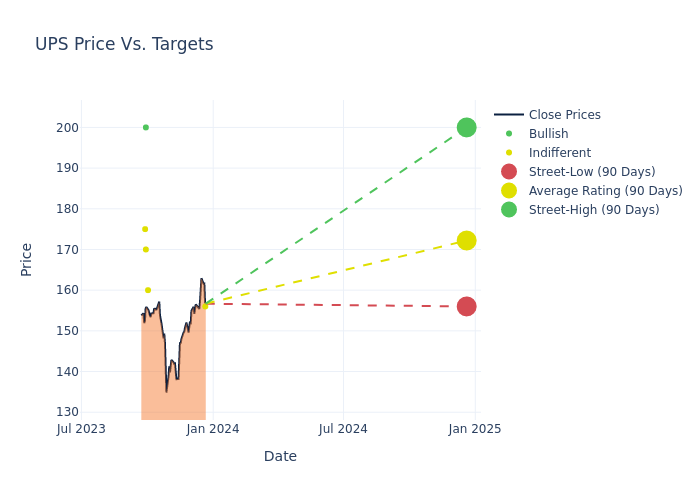

In the assessment of 12-month price targets, analysts unveil insights for United Parcel Service, presenting an average target of $173.17, a high estimate of $200.00, and a low estimate of $156.00. Experiencing a 4.75% decline, the current average is now lower than the previous average price target of $181.80.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive United Parcel Service. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brian Ossenbeck | JP Morgan | Lowers | Neutral | $156.00 | $165.00 |

| Brian Ossenbeck | JP Morgan | Lowers | Neutral | $178.00 | $186.00 |

| Bascome Majors | Susquehanna | Lowers | Neutral | $160.00 | $173.00 |

| Patrick Tyler Brown | Raymond James | Lowers | Strong Buy | $200.00 | $205.00 |

| Parash Jain | HSBC | Announces | Hold | $170.00 | - |

| Brandon Oglenski | Barclays | Lowers | Equal-Weight | $175.00 | $180.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to United Parcel Service. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of United Parcel Service compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for United Parcel Service's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of United Parcel Service's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on United Parcel Service analyst ratings.

All You Need to Know About United Parcel Service

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 25 million packages per day to residences and businesses across the globe. UPS' domestic U.S. package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder.

Key Indicators: United Parcel Service's Financial Health

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Decline in Revenue: Over the 3 months period, United Parcel Service faced challenges, resulting in a decline of approximately -12.83% in revenue growth as of 30 September, 2023. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: United Parcel Service's net margin excels beyond industry benchmarks, reaching 5.35%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 5.75%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.6%, the company showcases effective utilization of assets.

Debt Management: United Parcel Service's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.33.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.