Loading...

Loading...

By

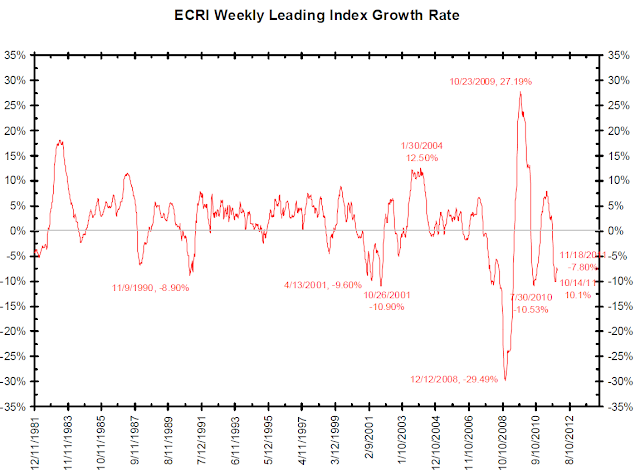

EconMattersThe U.S. economy is showing signs of life with good economic numbers after the ECRI (Economic Cycle Research Institute)

declared on 30 Sep. that the U.S. has already or is about to dip into recession.

WSJ Market Beat

noted that even ECRI's own weekly leading index (WLI) came in at 122.5 with the latest reading, the highest since early September. However, ECRI said it relies on the longer-term WLI (See Chart Below) when it made the dreaded 'R' call over two months ago.

(The long-term WLI is available only to ECRI's paying clients, but the chart below was posted at The Big Picture via Jim Bianco on 9 Dec.) The bottom line is that ECRI says its recession call still stands. Lakshman Achuthan, co-founder of ECRI said in a Bloomberg TV interview

(Clip Below) on 8 Dec. that

Loading...

Loading...

“This one [downturn] is persisting. Give us a year, and you'll see if we are right on our recession call."

Wall Street obviously has an entirely different view from the ECRI.

The chart below from

the Bespoke Group shows the Intrade contract betting on whether the US will go into a recession in 2012. For the contract to pay out, US real GDP would need to be negative for two consecutive quarters. Right now, the odds of a recession in 2012 are at 38.2% based on actual monetary bets, down from a high near 50% in early October as U.S. economic data have gotten much better since.

For now, we'd agree with Achuthan's when he remarked, “You're not going to know whether or not we're wrong until a year from now.” Only time will tell if ECRI or Wall Street has the brighter crystal ball.

©

EconMatters All Rights Reserved |

Facebook |

Twitter |

Post Alert |

KindleLoading...

Loading...

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in