Back in September, we called out the flawed business model of Angie’s List ANGI. Our call was quickly vindicated, as the stock had fallen by 40% in mid-December. However, over the past month ANGI has experienced a mini-revival, and the stock has come back up 15%, though it’s still down 16% since our call.

Value Trap

Analysts have helped to push the stock upward, as Raymond James upgraded ANGI to a “Strong Buy” on January 9 and B. Riley upgraded it to a buy last Friday. Raymond James highlighted ANGI as a strong value after the recent price decline.

I’m not sure how these analysts define “value”. The stock is cheap only in comparison to the massively inflated valuation of last summer. ANGI has still never made a profit, and while revenues are growing fast, so are expenses.

When I discuss valuation, I am specific and transparent. Ourdiscounted cash flow model reveals just how much growth is still priced into ANGI. Even if ANGI can attain 1% pre-tax margins next year and grow to 5% margins after that, it would still need togrow revenue by 25% compounded annually for 14 years to justify its current valuation of ~$17/share. That doesn’t look like much of a value to me.

Business Model Is Still Flawed

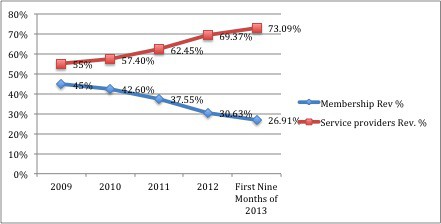

The fundamental issue with Angie’s List is that it portrays itself as a “consumer-driven organization” while actually making over 2/3 of its revenue from advertisers. Companies can pay to improve their search placement and even get bumped down simply for not paying. In some cases, the best-reviewed company might not make it onto the first page of search results.

Angie’s List’s selling point is that, since it collects revenue from members, it can provide more accurate reviews than free sites such as Yelp YELP. With such a huge portion of revenue coming from advertisers, however, it’s clear to which party ANGI really needs to cater. See Figure 1 for details.

The past few months have shown that the problem is only getting worse for ANGI. Figure 1 shows that the percentage of revenue from advertisers has grown even more in 2013.

Figure 1: Service Provider Revenue vs. Membership Revenue

With that much money coming from advertisers, ANGI is forced to give them preferential treatment, even at the expense of accurate reviews. Last month the New York Times ran an article explaining how ANGI removes customer complaints from the site after the company addresses the complaint. This allows companies to just pay a refund and make it appear as if they have a spotless customer service record.

Consumer Reports also released a report that harshly criticized Angie’s List and compared the quality of its reviews unfavorably to Consumers Checkbook and Google+ Local. Also in December, a lawsuit was filed by investors against Angie’s List claiming the company misled investors as to how much of its revenue came from service providers.

Competition is Increasing

We highlighted the competition ANGI faces from Yelp, the Better Business Bureau, and others back in September. However, another potentially disruptive competitor has sprung up in recent months. Small startup Porch.com recently got a significant investment from Lowe’s LOW and launched in late September. Porch focuses on home improvement projects and uses data like customer retention to supplement customer reviews.

Revenue trends seem to support the idea that increased competition is weighing on ANGI. Over the first nine months of 2013, ANGI grew revenue by 61% year over year, while in 2012 it grew revenue by 73%. While ANGI is still growing fast, that growth is slowing as awareness of the poor quality of ANGI’s reviews grows.

Insiders Keep Selling

I highlighted insider selling in my report in September as well and said that ANGI looked like a pump and dump. To some extent, however, it made sense for there to be some selling back then when ANGI was at all time highs and had doubled over the past year. If those executives really believed in the company, however, one would expect to see them buying in early December when the stock was down 40% and supposedly a good value.

Instead, insiders have just kept on selling, to the tune of 331,000 shares (2% of insider shares held) since early September. They haven’t been dumping the stock too quickly, but insiders are definitely taking some profits on ANGI.

The insiders haven’t changed their stance on ANGI, and neither have I. Don’t be fooled by the analyst upgrades or the rebound in the past month. This is a dead cat bounce as investors who haven’t done proper diligence think they’ve found a “value” stock in ANGI. Further slowdowns in growth and continued losses should convince the market that ANGI remains significantly overvalued.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.