( click to enlarge )

Yelp Inc YELP Strong Breakout on heavy volume. Buyable on a pullback to the pivot. The technical chart shows a continuation of the trend with MACD and RSI in the Bullish areas. There is a good chance the stock will continue to move up.

( click to enlarge )

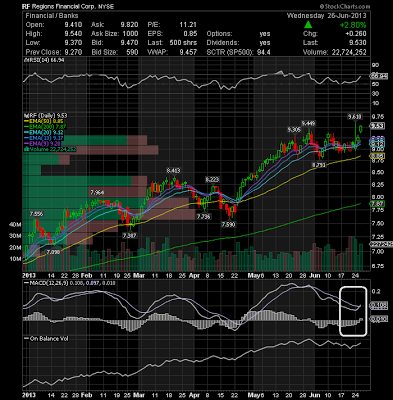

Regions Financial Corporation RF Stalking as a potential swing long above 9.61 MACD crossed up signaling a buy. Lets see if tomorrow confirms the signal

( click to enlarge )

Research In Motion Ltd BBRY is still consoladating within a symmetrical triangle. Eventually this pattern will be resolved Friday after the earnings report. However, all technical indicators appear to be setting up for a nice bullish move. The RSI crossed above 50 and +DI crossed above -DI indicating renewed buying pressure. MACD is about to cross the zero line, signifying even more upside being possible. The volume also was above average today and I'm hoping we will see a continuation tomorrow. Today's high was $15, which is resistance for the follow through move. Note earnings 06/28

( click to enlarge )

Splunk Inc SPLK is setting up nicely for a breakout, but I'd like to see a move above 47,21 on good volume before getting involved.

( click to enlarge )

Citi Trends, Inc. CTRN On watchlist no trigger yet. Long above $14.36. The stock has very strong support at 13.50

( click to enlarge )

Wells Fargo & Co WFC has become increasingly bullish and is currently consolidating in an attractive pattern. A move past $41.69 would be a strong indicator of a further uptrend in the stock.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in