( click to enlarge )

Apple Inc. AAPL daily chart seems to have bottomed for now. The stock closed again above the 9 & 13 day moving averages and MACD registered a buy signal. Only a decline below $419 would negate the positive status of this stock in short-term. Let's see whether the stock can gather enough momentum to break through 446.6. If the Bulls are able to push through this level, there will be another rally towards 450.

( click to enlarge )

I had Zynga Inc ZNGA on my watchlist a few times this month and today it broke out with volume expansion. I believe we willl see some nice follow through tomorrow. Next resistance lies at $4.46

( click to enlarge )

Netflix, Inc. NFLX dailly chart looks weak. The stock price closed again below the 20-day moving average of $184.37. As long as prices remain below this moving average, traders will view this development as a sign of weakness. In addition, the MACD is slopping down on the daily, so my bias is down. Price has now support at 175.

( click to enlarge )

Caesars Entertainment Corp CZR stalking as a potential swing long above 14.25

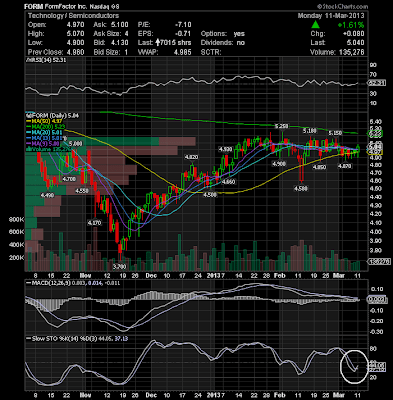

( click to enlarge )

FormFactor, Inc. FORM back over $5. The stock displayed relative strength today closing again above its 50-day moving average. I remain bullish. Short-term levels to watch $5.15 and then $5.23

( click to enlarge )

Very strong follow-through day for MannKind Corporation MNKD The short term technicals are overbought. Any pullback here can be bought.

( click to enlarge )

Vonage Holdings Corp. VG Still waiting for a breakout from the daily chart.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in