There has been a brutal sell-off in electric vehicle stocks and there' a chance they go even lower

Last June, shares of Nikola Corporation NKLA traded above the $80 level and they're now trading just above support at $10. This is where the shares were last April when the stock started to soar.

Investors who bought Nikola at this time last year and didn’t sell were looking at a profit, in spite of the recent sell-off.

Click here to check out Benzinga’s EV Hub for the latest electric vehicle news.

But if the current support breaks, even these investors will have a loss. A number of them will regret holding their stock for so long. Many may decide to sell. This could push the share price even lower.

Li Auto LI broke the support at $21.

Support is a large concentration of buyers gathered around the same price level. Shares often rally after they reach support levels.

This happened each time LI reached $21 in early and in late March, but now this support has been broken. This means the buyers who formed the support have left the market.

Sellers will be forced to accept lower prices, which could cause the decline to continue.

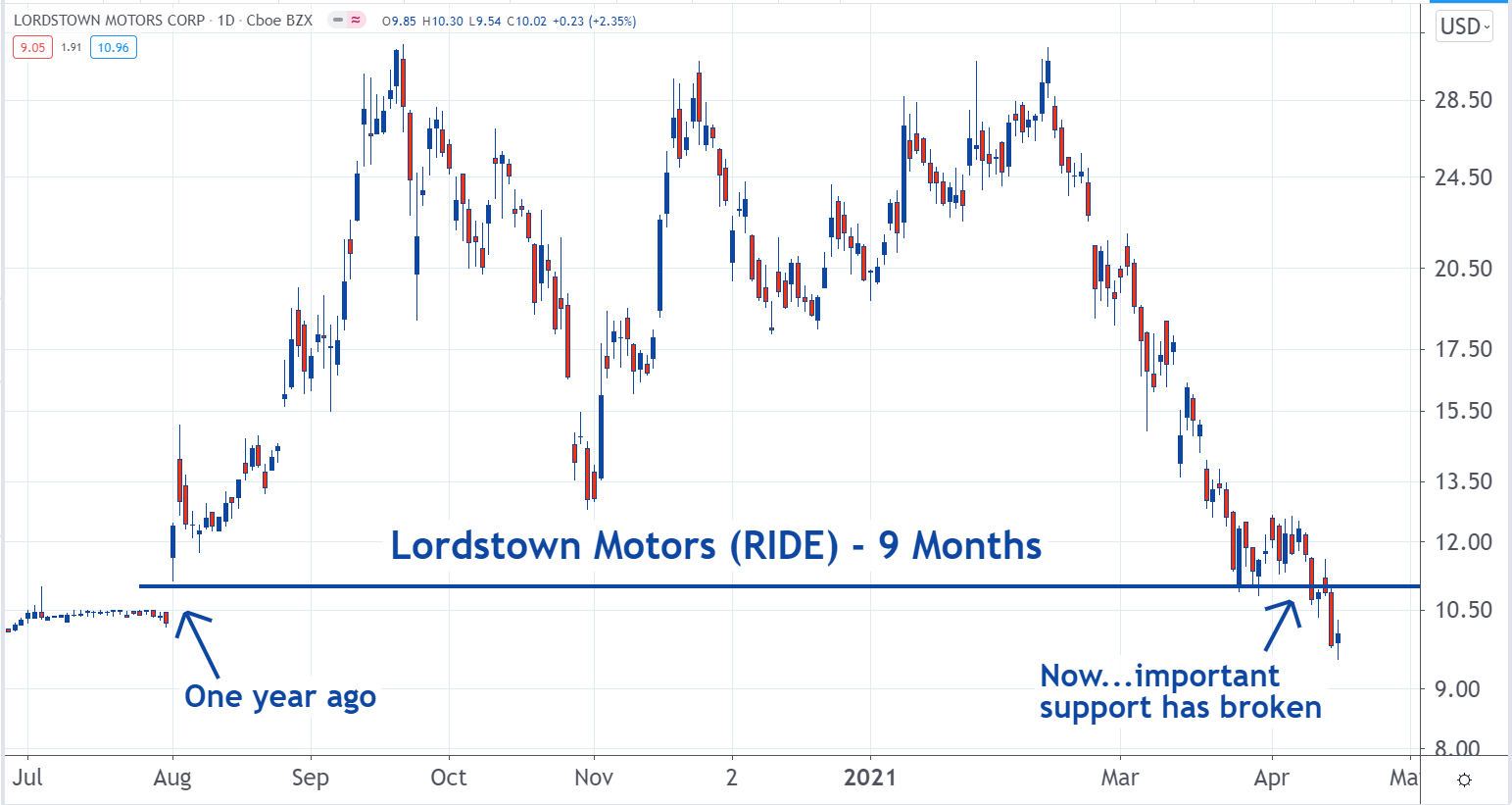

Lordstown Motors Corp RIDE broke support at $11. Shares are now trading below where they were last August when the rally started.

Former support levels can convert into resistance. This happens when buyers who bought the stock at $11 decide to sell.

A number of these now disgruntled buyers don’t want to take a loss. They will try to sell their shares if they get back to $11, which could cause resistance to form. It could keep a top on the shares.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.