The CBOE Volatility Index (VIX) recently closed above 20 for the fifth time in 30 days. These are the most closes above 20 in any 30 day period since the 8-21-15 to 9-21-15 time frame.

Why is higher volatility different now than in September?

High asset volatility, or higher return dispersions, end up being reflected in a higher cost of equity as an assets “beta” gets multiplied against the capital market’s required premium. A higher cost of equity will increase the left side of a firms Weighted Average Cost of Capital formula.

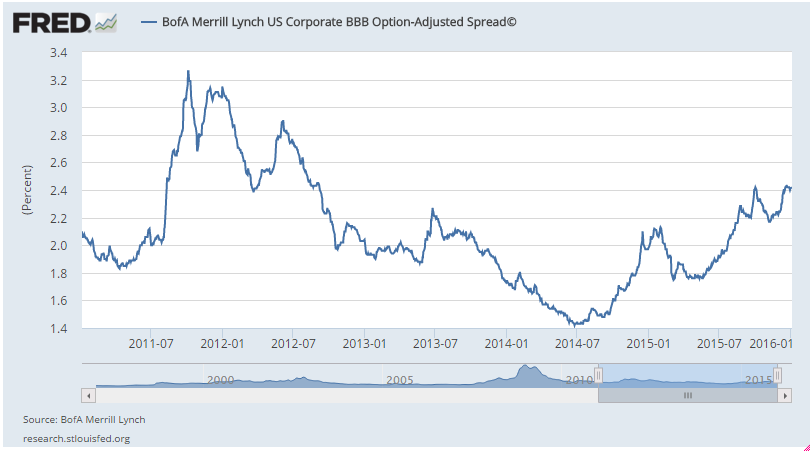

Volatility is currently high as is the investment grade credit default spread. Earlier this week, the BofA Merrill Lynch US Corporate BBB Option-Adjusted Spread eclipsed its previous 3 year high of 2.42 percent that was recorded on 10/2/15. This new high in spread came on a lower high in volatility.

The market isn’t reflecting the same level of nervousness?

A higher high in credit spreads is implying that the market has less confidence in corporate debt service levels now than it did during the last bout of volatility in September. Firms that need to raise debt in the current environment are going to pay a higher cost for new debt. The debt side of their WACC calculation is going up.

We can assume that if the market is skeptical of debt service levels, it is also skeptical of cash flows given that cash flow is the key to debt service.

If cash flows are going lower and WACC’s are going higher, then net income will be heading lower as asset net present values that are currently on the books begin to get written down. This negative feedback loop that starts to form will end up effecting capital expenditure budget projections and corporate cost structures will begin to come under pressure.

As we enter the Q4 “confession season”, the market looks like it is about to get WACC-ed!

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.