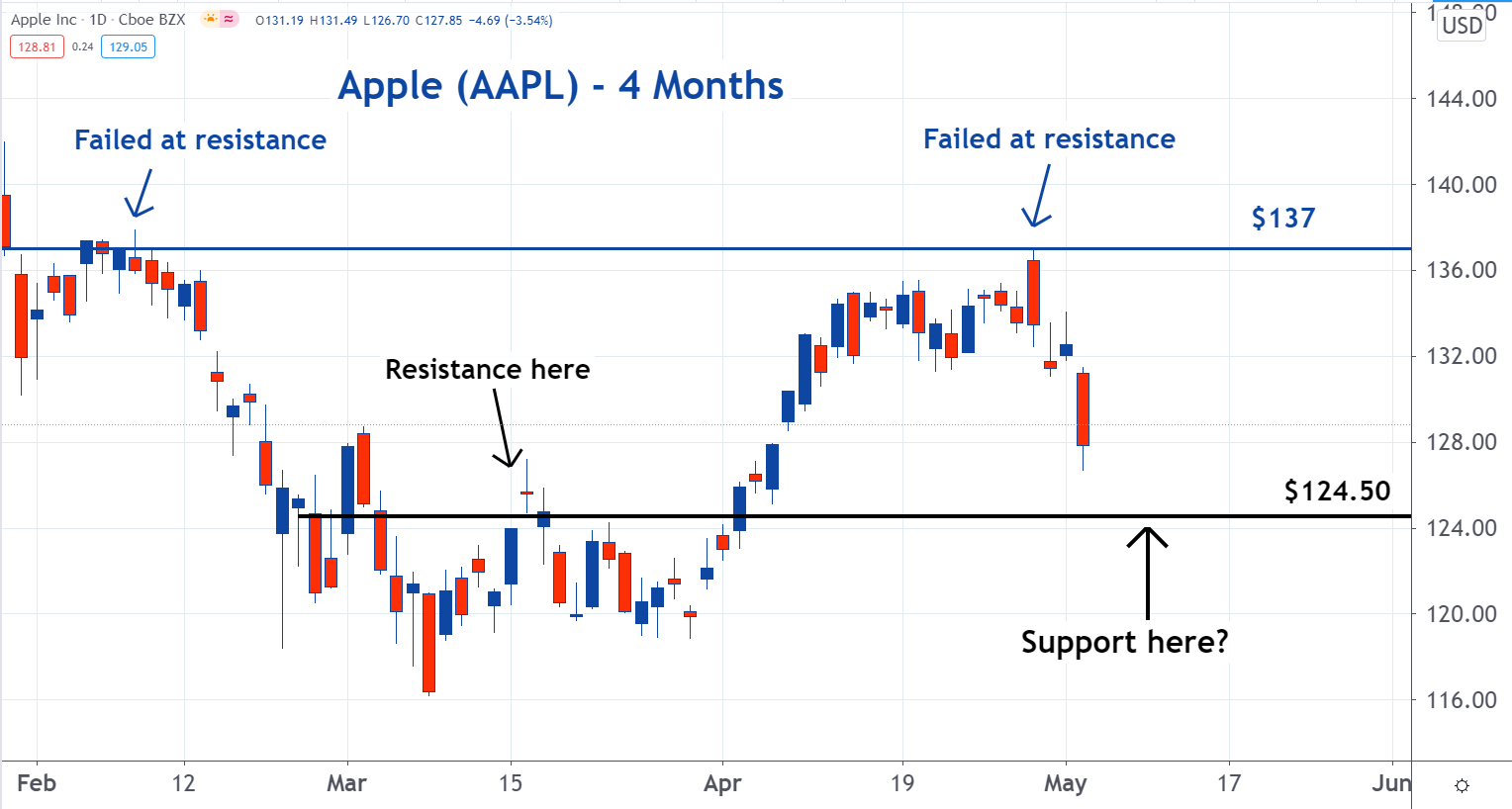

When Apple Inc.'s AAPL stock failed to get through the resistance at the $137 level, it became obvious that the technology sector was about to sell-off.

At 22% of the S&P 500 technology sector, Apple is the sector’s biggest position. This means movements in Apple have a bigger influence on the tech sector than other stocks do.

There’s a good chance the sell-off ends if Apple reaches levels around $124.50. Levels that had previously been resistance can turn into support, and $124.50 was resistance for Apple in March. Resistance turns into support because of seller's remorse.

See Also: Apple Acquires A Company Every 3-4 Weeks. How Does It Go About Making Those Purchases?

Many of the investors who sold at $124.50 regret doing so because now the stock is higher. A number of these remorseful sellers decide to buy their stock back if they can get it for the same price they sold at.

As a result, a large number of buy orders are placed at $124.50. If there are enough of these buy orders, it will create support. This support, or abundance of buy orders, could put a floor under the stock and halt the sell-off.

See also: How To Buy Apple Stock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.