U.S. Global Investors launched a brand new exchange traded fund (ETF) on Thursday called the U.S. Global Jets ETF JETS. The new ETF is currently the only airline ETF and provides investors a new, easy pure-play option on the rejuvenated industry.

Benzinga had a chance to speak with Frank Holmes, CEO and Chief Investment Officer of U.S. Global Investors, about the new ETF.

Stock Selection

The JETS ETF is comprised of four tiers of airline stocks.

The top tier will make up nearly half of the ETF’s portfolio and will consist of an equal weighting of the top four domestic U.S. airline stocks based on market cap and load factor. For the foreseeable future, this tier of holdings will likely consist of Delta Air Lines, Inc. DAL, United Continental Holdings Inc UAL, American Airlines Group AAL and Southwest Airlines Co LUV.

The second tier of holdings will consist of 4 percent stakes in the next five largest U.S. domestic airlines. Tier three will include 3 percent allocations to the four highest-ranked remaining U.S. airline companies based on cash flow, sales growth, gross margin and sales yield.

The bottom tier will consist of 1 percent stakes in the top 20 international airline industry companies based on similar metrics used for tier three.

Room For Upside?

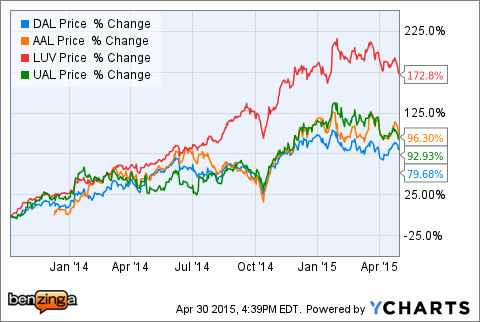

Fundamentals in the airline industry have been improving for quite some time, but with share prices of the “Big 4” already up more than 80 percent in the past two years, Benzinga asked Frank Holmes if there is upside remaining for the industry.

“When I look at trucks and trains, they trade at 19 times earnings, but the airlines still trade at 9 times earnings,” Holmes explains.

This Cycle Is Different

Holmes told Benzinga that he believes the current airline industry cycle is different from previous cycles.

“What there airlines have been doing, unlike previous cycles, is increasing their dividends, buying back their stock, and paying down their debts. When I look at the numbers from the first quarter, the free cash flow yield is up 500 percent from a year ago.”

According to a press release by U.S. Global, JETS is a smart beta, passively managed fund with an expense ratio of 0.60 percent.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.