This Technical Trigger was provided by TraderMinute.

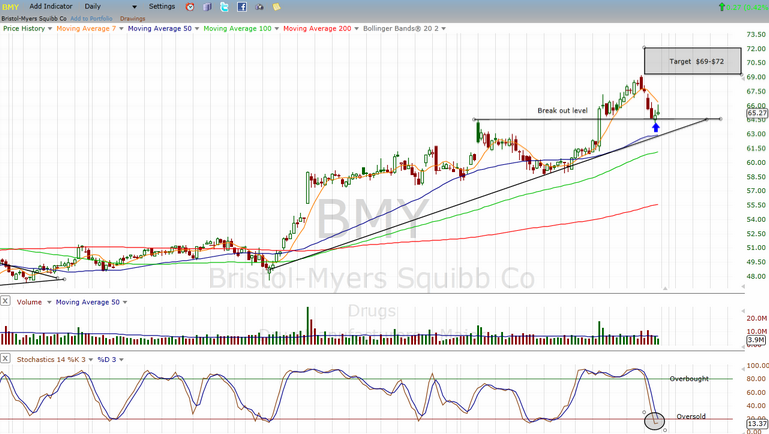

There is some interesting price action going on in Bristol-Myers Squibb Co BMY that makes it a possible swing trade play. Bristol-Myers Squibb has been trending up since October and recently broke out to new highs and pulled back to its break out level.

Commonly, break out levels that are retested hold in bull markets and spring higher.

The Slo Stochastic and over bought/oversold indicator is showing a swing up indicating some bullish momentum in the stock.

The other bullish indicators on this stock is that the price action has continued to stay above the 50-day moving average. The volume is in line with the price action.

If the retest on Bristol-Myers holds, look for it to spring up to $69 to $72 over the next week or two. They key level to watch to the downside is $62.

Failure there, and it could pull back to around $62.

Options Corner: The April 65 Calls are trading for 1.33 and have open interest of 2,561, which offers a cheaper way to play the potential for upward move instead of buying the stock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.