Many investors are reluctant to buy cryptocurrencies. This isn’t a surprise. They're still relatively new and they can be hard to understand.

But there may be a solution for these investors. Some funds invest in cryptocurrencies and can give investors exposure to cryptos, but trade just like regular stocks or ETFs.

These trusts include the Grayscale Bitcoin Trust GBTC, the Grayscale Ethereum Trust ETHE and the Grayscale Litecoin Trust LTCN.

See Also: Best ETFs

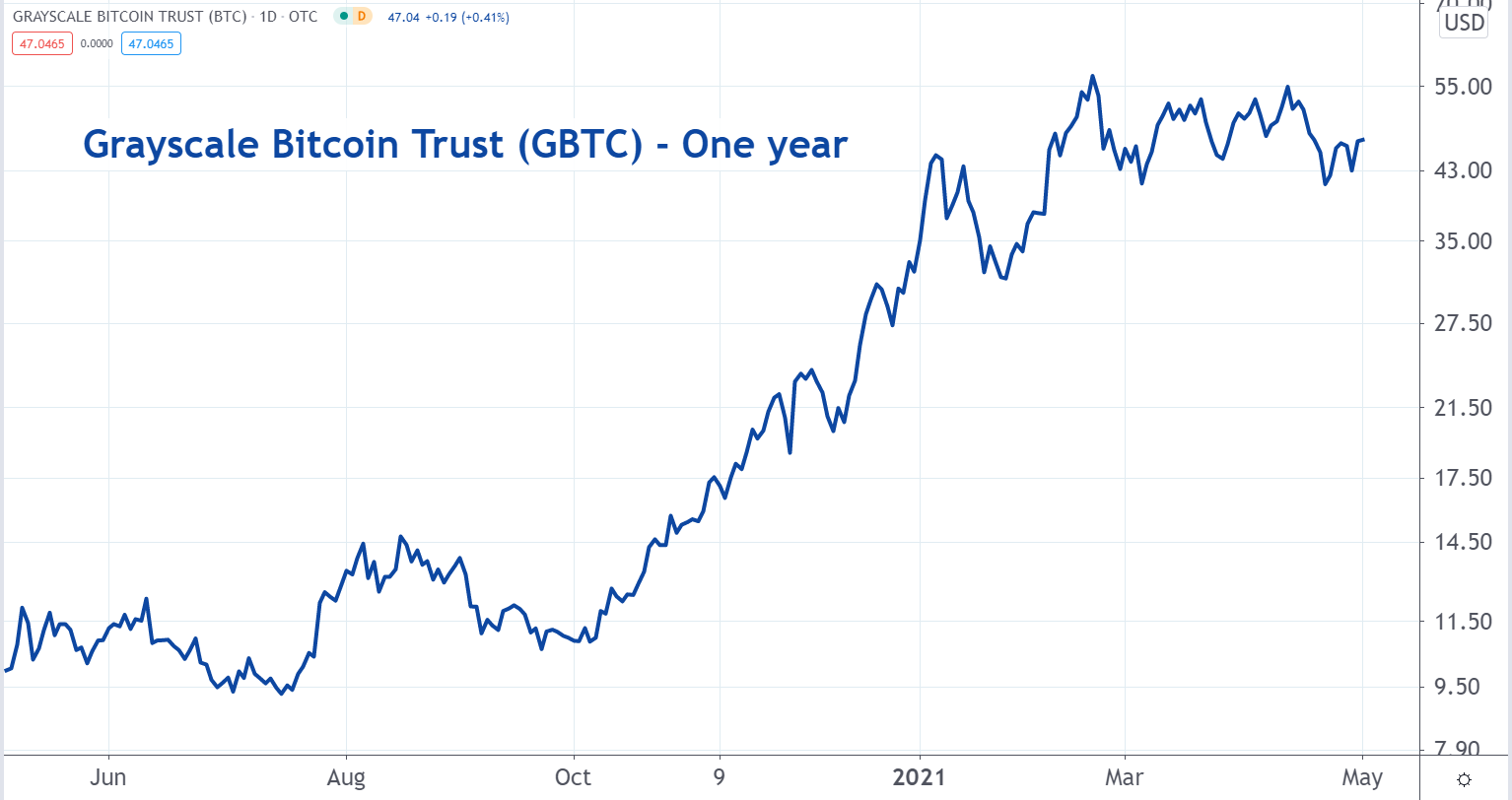

GBTC invests its assets solely into Bitcoin. The investment objective is to reflect the price performance of Bitcoin minus fees and expenses. The annual fee is 2% and the assets under management (AUM) are about $36 billion.

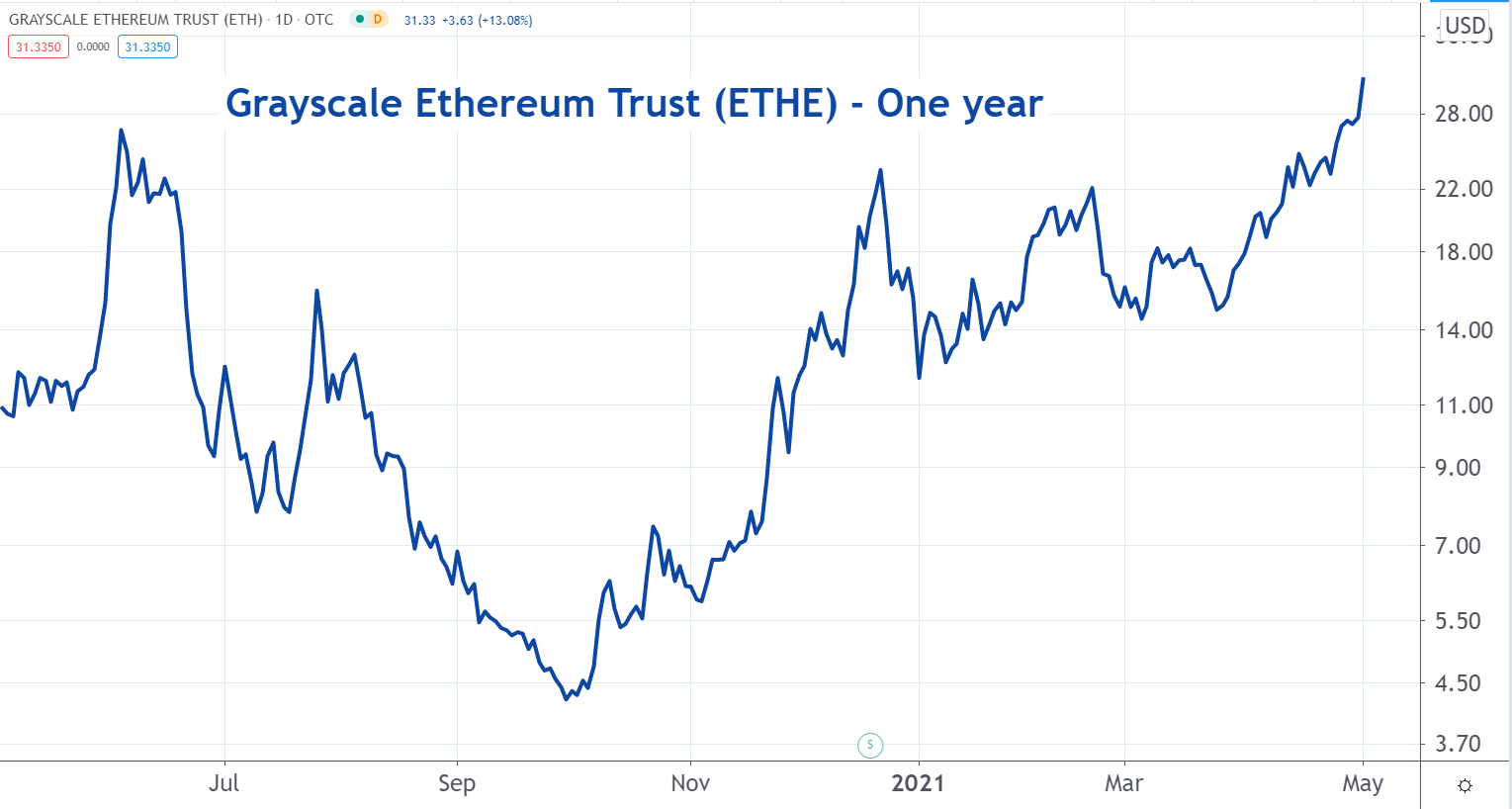

ETHE invests its assets solely into Ethereum. The investment objective is to reflect the price performance of Ethereum minus fees and expenses. The annual fee is 3% and the AUM is about $437 million.

LTCN invests its assets into Litecoin. The investment objective is to reproduce the price performance of Litecoin minus fees and expenses. The annual fee is 2.5% and the AUM is about $395 million.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.