Should These Be On Your List Of Penny Stocks To Buy Today?

Penny stocks have become synonymous with both institutional and retail investors in the past six months. There are a few reasons why penny stocks are seeing so much popularity in that time frame. For one, penny stocks are defined as any security that is under $5. This means that access to all types of investors is high. Second, the growth potential with cheaper stocks can be much larger than with higher-priced securities.

Within the stock market, investors should focus on both the popular penny stocks and the ones that are not as popular. This can help give investors a broad-based portfolio to work from. Additionally, investors should always make sure to research a company to the best of their ability.

Read More

- Penny Stocks On Robinhood To Buy Under $1; 2 With 212%-809% Targets

- Are Marijuana Stocks On Your List Right Now? 5 Penny Stocks To Watch

This ensures that there is less of a chance of seeing unexpected price swings. The best investors are always the ones with the most information at hand. And with the internet only a click away, we can all be the most well-informed investors out there. With all of this in mind, let's take a look at four penny stocks that are grabbing investor attention right now.

Penny Stocks to Watch

- Ever-Glory International Group Inc. (EVK Stock Report)

- Waitr Holdings Inc. (WTRH Stock Report)

- Party City Holdco Inc. (PRTY Stock Report)

- Northwest Biotherapeutics Inc. (NWBO Stock Report)

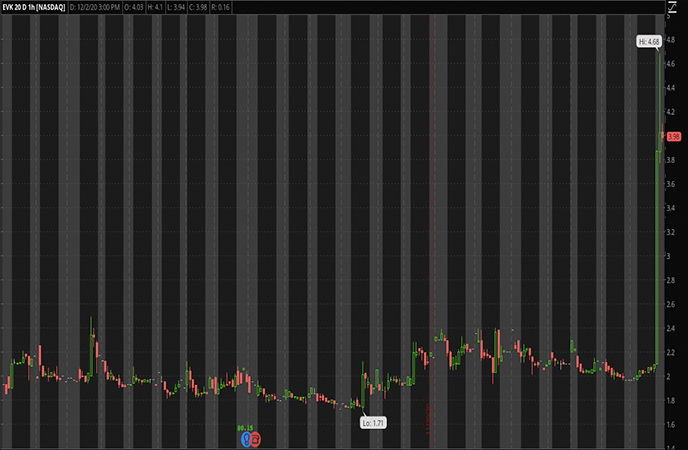

Penny Stocks to Buy [or avoid]: Ever-Glory International Group Inc.

Ever-Glory International Group Inc. is a company that works with its subsidiaries to provide retail apparel to Asia, Europe and the U.S. The company operates in both the retail and wholesale sectors of the clothing industry which makes it quite broad. The company states that it has as many as 1,038 retail locations in China alone, in addition to providing its clothing to other retailers. In addition, the company has seen its shares shoot up by around 200% in the past six months. On December 2nd, shares of EVK stock shot up by around 7% during intraday trading before shooting up another 112% during after hours. So, why the major post-market bull run?

Well, there isn't one piece of news in particular that resulted in the latest price jump. But, to better understand why this may have occurred we can look at its Q3 2020 results. On November 13th, the company published results for the period ending on September 30th. CEO of the company, Yihua Kang, stated that "during the third quarter, we maintained our focus on developing the retail business through our multi-brand strategy and store network optimization initiative, while improving our wholesale business by upgrading customer portfolio and enhancing our account receivables."

In the report, sales came in at around $80 million. This represents a decrease of around 30% over the previous years same quarter. While this can be chalked up to covid related issues, it still is not the most impressive. If we look at the gain, we can also see a movement toward Chinese buyers purchasing "made in China" goods. This movement has occurred in the past few months, and could be a driver behind the recent price action. While it still remains largely unknown, EVK stock could be a penny stock to watch for some.

Penny Stocks to Buy [or avoid]: Waitr Holdings Inc.

Waitr Holdings Inc. is considered to be a covid penny stock to watch due to its role in the industry. The company provides online food ordering services as well as delivery. While it does compete with some big name companies, Waitr Holdings has managed to find its stride in the industry.

[Click To Read More] Looking For Hot Penny Stocks Today? 5 Making New December Highs

At the end of last year, the company reportedly had as many as 18,000 restaurant partners spanning 640 cities in the U.S. Recently, the company announced its Q3 2020 results, beating estimates by a small amount. During the quarter, the company reported $0.04 in EPS compared to a Zacks estimate of $0.03 EPS. In the past four quarters, the company has been able to beat out expectations twice.

On December 2nd, shares of WTRH stock shot up by as much as 11% including after hours trading. YTD however, shares of WTRH stock are up by almost 1000%. This is quite a staggering gain and represents that there is a great deal of bullish sentiment surrounding WTRH stock. As a food delivery platform, WTRH stock has managed to provide big returns during Covid. With rates of the illness climbing once again, we could see more consumers turn to online food ordering services. With this in mind, WTRH stock could continue to be considered a penny stock to watch.

Penny Stocks to Buy [or avoid]: Party City Holdco Inc.

Party City Holdco Inc. is another one of the surprising gainers on December 2nd. During the trading day, shares of PRTY stock shot up by a solid 6.5%. In the past six months, shares of PRTY stock are up by almost 270%. For some context, Party City operates as a designer and manufacturer of various party supplies for sale in the U.S. The company works in both the wholesale and retail party supply markets.

As the year comes to an end, companies like Party City are seeing the benefit of the holiday season. While this holiday season is unlike any other, the company has still seen a great deal of bullish momentum. In its latest Q3 financial report, the company blew expectations out of the water. Net income for the year came in at around $239 million or around $2.24 per share.

In the previous year, the company brought in a major loss of around $281 million, illustrating just how good this past quarter was. Brad Weston, CEO of the company stated that "as mentioned on our last call, we planned conservatively for Halloween this year, given the truly extraordinary environment as a result fo the pandemic and election uncertainty.

We positioned ourselves for a decline from an inventory, assortment, and expense standpoint as well as from a Halloween City pop-up store perspective. While the company did pull in a $765 million operating loss in the first nine months of the year, the holiday season could help to have investors consider PRTY stock a penny stock to watch.

Penny Stocks to Buy [or avoid]: Northwest Biotherapeutics Inc.

Northwest Biotherapeutics Inc. is a company that works in the development stage of the pharmaceutical industry. The company claims that it is working on developing a wide range of immunotherapies that can be used in the treatment of cancer. On December 2nd, shares of NWBO stock shot up by around 9% including after hours trading. In the past six months, NWBO stock has returned almost 350% to its investors. One of the main reasons for the recent bull interest in the company is its 14-year long trial that is evaluating its DCVax-L treatment.

This Phase 3 trial only recently concluded, and now investors are simply waiting for what will happen next. The drug, which is used in the treatment of Glioblastoma, can help to shift the standard of care for this ailment. The phase 3 trial produced results with roughly 331 participants in the study. One thing to keep in mind is that DCVax-L is currently the only drug that the company has in its pipeline.

[Read More] Top Penny Stocks To Watch For December 2020; 5 Names To Know Now

With around $15 million in assets and $6 million in cash, the company looks like it could be in a good position to continue moving forward. As a biotech company, it has received a great deal of attention since the start of the Covid pandemic. But, while we wait for the data to be released, investors can consider the above factors for deciding whether or not it is a penny stock to watch.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.