This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

(Thursday Market Open) The Dow Jones Industrial Average futures traded higher before the market open as investors look to build on yesterday’s gains. This time, growth stocks may not be left at the starting line as Tesla’s (TSLA) earnings report late Wednesday is driving Nasdaq futures and Russell 2000 futures today.

Potential Market Movers

After Wednesday’s close, Tesla TSLA absolutely crushed earnings and revenue estimates. Analysts were expecting earnings per share (EPS) of $2.24, and the automaker and clean energy manufacturer delivered $3.22. Tesla also set a record for its operating profits at $3.6 billion, well above the forecast of $2.6 billion. TSLA was able to ward off inflation by finding suitable substitutes for shortages and knowing how to navigate the supply chain. The stock fell nearly 5% on Wednesday ahead of the announcement but rallied more than 6% in extended-hours trading.

Among other companies reporting earnings this morning, tobacco giant Philip Morris PM reported better-than-expected earnings and revenue despite being hurt by the loss of business in Ukraine and Russia. PM said it doesn’t expect the two warring countries to contribute to their earnings the rest of the year. That said, PM is up more than 14% from its March low as investors have been focusing on consumer staples.

Transport stocks may get a boost from Union Pacific UNP which beat on top- and bottom-line earnings numbers, prompting UNP to rise 1.71% in premarket trading. UNP saw operating revenue and income rise 17% and 19% respectively. However, the company said it didn’t meet its operations goals and that it will find more ways to increase efficiency and utilization.

The sector should also get a boost from airlines because American Airlines AAL, United Airlines UAL, and Alaska Air ALK beat estimates. AAL really soared ahead of the opening bell, rising 10.7% in premarket trading.

Moving over to communications, AT&T T topped earnings estimates despite missing on revenue. However, the stock was still up more than 1% in premarket trading. Its quarter included the spinoff of WarnerMedia on April 4 to merge with Warner Bros Discovery WBD. The spinoff happened just in time to miss the negative pull from Tuesday’s Netflix NFLX earnings miss.

In the financial sector, Blackstone BX rallied more than 5% in premarket action after topping for earnings and revenue estimates by a handsome margin. The investment firm saw big gains in its real estate business as well as its logistics and energy investments.

A couple of economic reports came out this morning starting with higher-than-expected jobless claims, though the overall number was lower than the previous report. The Philadelphia Fed Manufacturing Index came in lower than expected for April, which was also lower than March’s totals. While the lower number is concerning, the 17.6 reading is still well above zero line.

The Cboe Market Volatility Index (VIX) is now trading below 20—a good sign for the bulls as investor confidence is growing. The 10-year Treasury yield (TNX) was up just 4 basis points ahead of the market open. If yields stay in check, the rally could continue. However, Fed Chairman Jerome Powell will speak twice this afternoon which is likely to draw a lot of attention from bond and stock investors.

Reviewing the Market Minutes

Despite the 10-year Treasury yield (TNX) dropping 73 basis points and the Cboe Market Volatility Index (VIX) moving back down near 20, as investors opted for value stocks over growth stocks. Apparently, the big earnings miss by Netflix (NFLX) was enough to ward off risk-seeking investors. NFLX fell more than 35% on the day and brought down a number of other streamers with it.

Investors favored “old economy” blue chips during the session as the Dow Jones Industrial Average ($DJI) led the other major indexes, climbing 0.71%. Meanwhile, the Nasdaq Composite ($COMP) dropped 1.22% and the S&P 500 (SPX) finished slightly lower at 0.06%. As the Nasdaq and S&P 500 were weighed down by mega cap tech stocks, the NYSE advancers still outpaced decliners by nearly 2-to-1. Additionally, the Russell 2000 (RUT) closed 0.37%. By contrast, the CRSP U.S. Mega-Cap Index fell 0.30%.

The Dow Jones Transportation Average ($DJT) was sitting near bear market territory two weeks ago but has since rallied 6.7%. It closed 1.49% higher on Wednesday. The index got a big lift from Avis Budget (CAR), which accelerated 11.9% after an upgrade by Barclays.

Banks continued to bounce upward yesterday as well. The PHLX KBW Bank Index (BKX) rallied another 0.70% to extend its rally to three days and more than 4%.

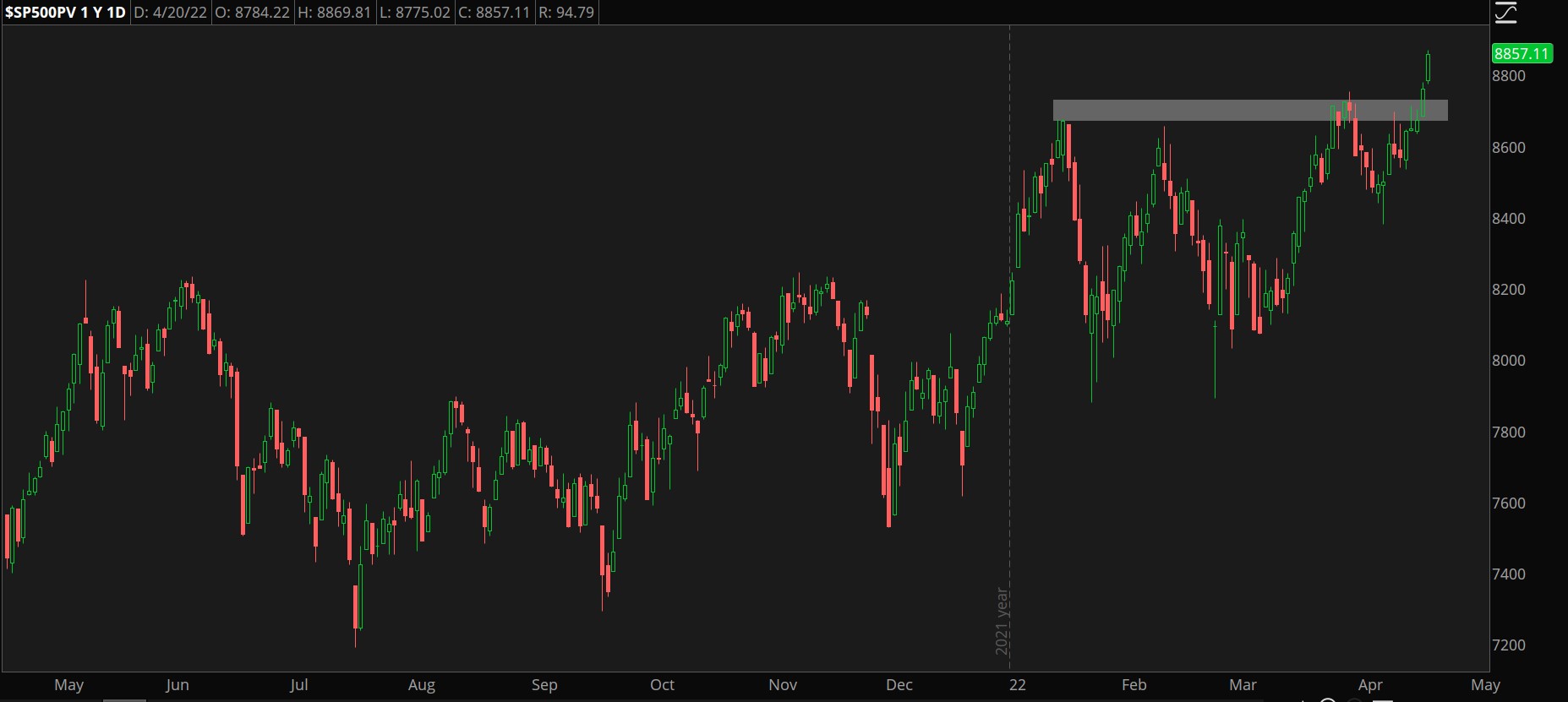

CHART OF THE DAY: VALUE SHOPPING. The S&P 500 Pure Value Index ($SP500PV—candlesticks) has broken resistance and is trading at a new all-time high. Data Sources: ICE, S&P Dow Jones Indices. Chart source: The thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

Three Things to Watch

Defense as Offense: Value stocks remain popular as higher yields continue to weigh on growth stocks. Currently, the value investing strategy and sectors including consumer staples, utilities, and healthcare appear to be fueling defensive portfolios. On Wednesday, the top sectors included real estate on top of consumer staples, health care, and utilities. Sectors commonly associated with growth like technology and consumer discretionary were the lowest performing sectors and the only two to end the day in the red.

New Highs List: Defensive stocks are littering the “new 52-week highs” list. A glance down the “New Yearly Highs” list on the thinkorswim® platform reveals companies like Stride (LRN) which is an education company, HCA Healthcare (HCA), Darling Ingredients (DAR), an ingredient manufacturer for foods, animal feed, fuel, fertilizer, and more, and AutoZone (AZO), which sells auto parts. Most of the stocks on this list the last week were utilities, consumer staples, and healthcare. There’s also a number of energy stocks mixed in these lists as well, although they appear to have seen a little less attention.

Technical analysts looking for potential candidates by using 52-week high lists as a search tool because these lists often contain uptrending and breaking out stocks. However, they often contain low-volume and penny stocks as well.

Treasury Auction: Investors may be warming to the idea of buying bonds. The U.S. Treasury Department saw strong demand at its 20-year Treasury bond auction with the highest yield sold at 2.095%. The bid-to-cover ratio, which compares the amount of dollars received versus the amount sold in an auction, was 2.8 times. This was the highest ratio since the 20-year bond was introduced in May of 2020.

The auction saw strong buying from indirect bidders which are commonly foreign entities like governments, central banks, investment funds, and individual investors. Often, U.S. Treasuries can help foreign governments or banks to secure their own currencies, or simply be used as a safe place to store funds. However, these buyers could be money managers as well, making it tough to evaluate the high interest from indirect bidders.

Notable Calendar Items

April 22: Earnings from Verizon VZ, American Express AXP, Honeywell HON, Newmont NEM, and Schlumberger SLB

April 25: Earnings from Coca-Cola KO, and Activision Blizzard ATVI

April 26: Durable goods orders, CB consumer confidence, new home sales, and earnings from Visa V, PepsiCo PEP, United Parcel Service UPS, and Texas Instruments TXN

April 27: Pending home sales, and earnings from Meta Platforms FB, T-Mobile TMUS and PayPal PYPL

April 28: Gross Domestic Product, Earnings from Apple AAPL, Amazon.com AMZN, Merck MRK, Intel INTC, McDonald’s (MCD)

TD Ameritrade® commentary for educational purposes only. Member SIPC.

Image sourced from Unsplash

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.