Stock index futures are mixed ahead of the open while investors try to digest yesterday’s selloff. Heavy selling into the close is often seen as a bad sign for stocks, so some positive movement is good if it can hold. The S&P 500 (SPX) broke support yesterday by trading below its August high. Additionally, the index broke below its 50-day moving average. Many technical analysts will see these events as a bearish sign for stocks, at least in the short term.

The Nasdaq Composite (GIDS) is testing its 50-day moving average and probably won’t get any help from Apple AAPL today. Apple is trading almost 3% lower on news that the company told its suppliers that demand for the iPhone 13 is lower-than-expected. This is the second warning this year from Apple on its iPhone 13 product.

However, it's not all bad for tech stocks. Snowflake SNOW was moving nearly 14% higher in premarket trading. The company reported higher-than-expected earnings and revenue and provided brighter future earnings guidance.

The Dow Jones Industrial Average ($DJI) could get a boost from its component Boeing BA which was rising 5.19% higher in premarket trading. The Chinese aviation authority issued a positive review of the Boeing 737 MAX plane that will allow the model to return to China after two and half years.

In the fight against Omicron, GlaxoSmithKine GSK and Vir Biotechnology VIR provided data showing that their vaccine was effective against the new variant. Glaxo and Vir traded 0.65% and 13.9% higher in premarket trading respectively.

Crude oil is slightly lower this morning before the bell. According to The New York Times, OPEC-Plus is meeting today to discuss Omicron uncertainty and angry customers. The group will determine its oil production as oil prices have been plummeting. They may wish to cut production to set a “floor” for oil prices and possibly even drive prices higher.

Gauging Uncertainty

The Cboe Market Volatility Index or VIX rose above 31 yesterday but has retreated to about the 29 levels. The 30 levels has historically been a significant point for the VIX. To add some context, the VIX traded between the 15 and 16 levels around the first of November. The increase reflects the rising uncertainty and fear that investors have around the markets right now. In fact, this is the highest level the VIX has seen since March of 2021.

Rising fear often leads to market volatility as investors look to the options and futures markets to hedge their portfolios. The Omicron variant apparently has investors spooked, to say the least, and now they appear to be hedging their portfolios. This morning’s strength in the Dow Jones Industrial Average Index futures could also reflect a “flight to quality” or in other words, investors may be moving into more established companies that can better weather the storms.

Retail Rollover

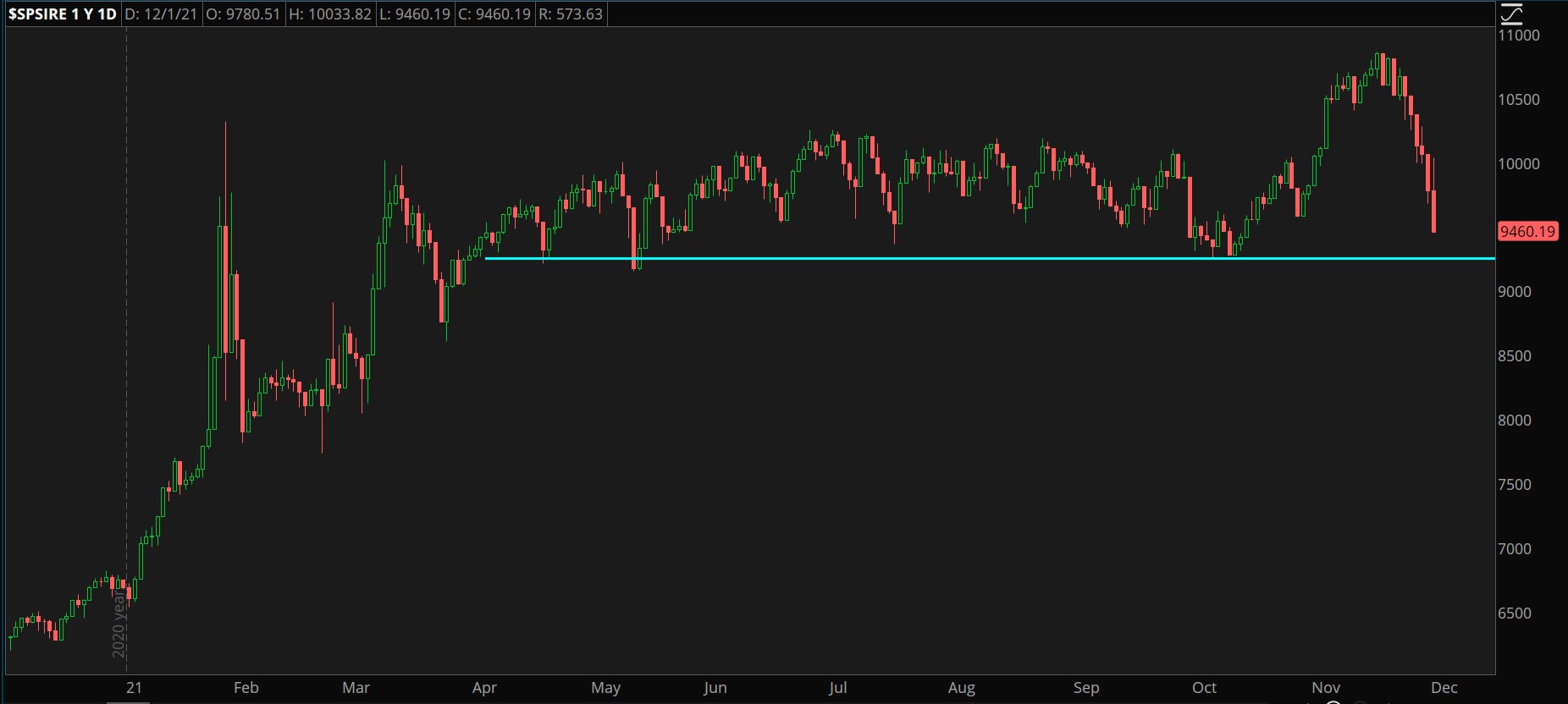

With a few weeks left until Christmas, retailers are hoping to see more spending from consumers. For many, the holiday shopping season started earlier in the year, which may have caused recent shopping events like Black Friday and Cyber Monday to come in a bit lackluster. Additionally, other factors could pressure year-end shopping, like inflation, a new coronavirus variant, and supply chain issues. Over the past couple weeks, some of these factors may have influenced the recent rollover in the S&P Retail Select Industry Index ($SPSIRE). That said, investors may be keeping an eye on longer-term historical support near 11,500 to see if prices can hold above this general range.

CHART OF THE DAY: FIRE SALE. The S&P Retail Select Industry Index ($SPSIRE—candlesticks) broke down after its breakout and is nearing an old support level. Data Sources: ICE, S&P Dow Jones Indices. Chart source: The thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

Analyst Expectations: By and large, analysts across the retail spectrum expect holiday sales for December to meet increased expectations. However, many have noted that there has been an unusually low level of retail shopping buzz this year, which may be due to dealing with the return to normal holiday gatherings, higher prices, early demand to beat supply chain issues, or out-of-stock items.

Recent shopping events, like Cyber Monday, generated $10.7 billion for retailers, or 1.4% less than last year, according to Adobe Analytics. Adobe noted that this was the first decrease in e-commerce transactions since 2012. However, much of the seasonal spending this year has been spread out, as retailers started their promotions early. Furthermore, pent-up demand from consumers who have higher levels of savings could provide a boost for December retail sales, according to former chairman and CEO of Saks, Steve Sadove.

New Variant: Fears of the new coronavirus variant Omicron broke just as consumers were getting ready for Black Friday shopping. Currently, these fears have not had a materially impact on retail shopping, but it may just be too soon to tell. With little known about the variant at this time, news reports have been followed by volatile market reactions. How the variant compares to COVID-19 will likely determine its impact on the retail economy.

This is not the first time consumers have been exposed to a coronavirus variant. The Delta variant, which was first discovered late last year, did not materially impact growth in the retail sector or the recovery in the broader economy. It also appears that this holiday season looks different from last year, due to a majority of Americans being vaccinated. Some analysts are taking it a step further, believing that the Omicron variant could actually increase retail sales, stating that consumers who were planning on different experiences like vacations or visits to the theatre may instead opt for more shopping.

Santa’s Supply Chain Issues: Supply chain issues across the retail industry are still heavily mixed. Some retailers are receiving an abundance of products that had been previously ordered, giving them a much wider selection of goods for seasonal shoppers. These retailers hold a significant competitive advantage over those who are still waiting on inventory orders that are months old. Furthermore, those retailers who end up receiving their Christmas products in February could face substantial losses in the coming year, as they are forced to issue heavy product markdowns. It will ultimately be up to those retailers that have received new inventory or can offer new deals to effectively communicate this information to consumers, luring them to spend more money.

TD Ameritrade® commentary for educational purposes only. Member SIPC.

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. The content was purely for informational purposes only and not intended to be investing advice.

Image Sourced from Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.