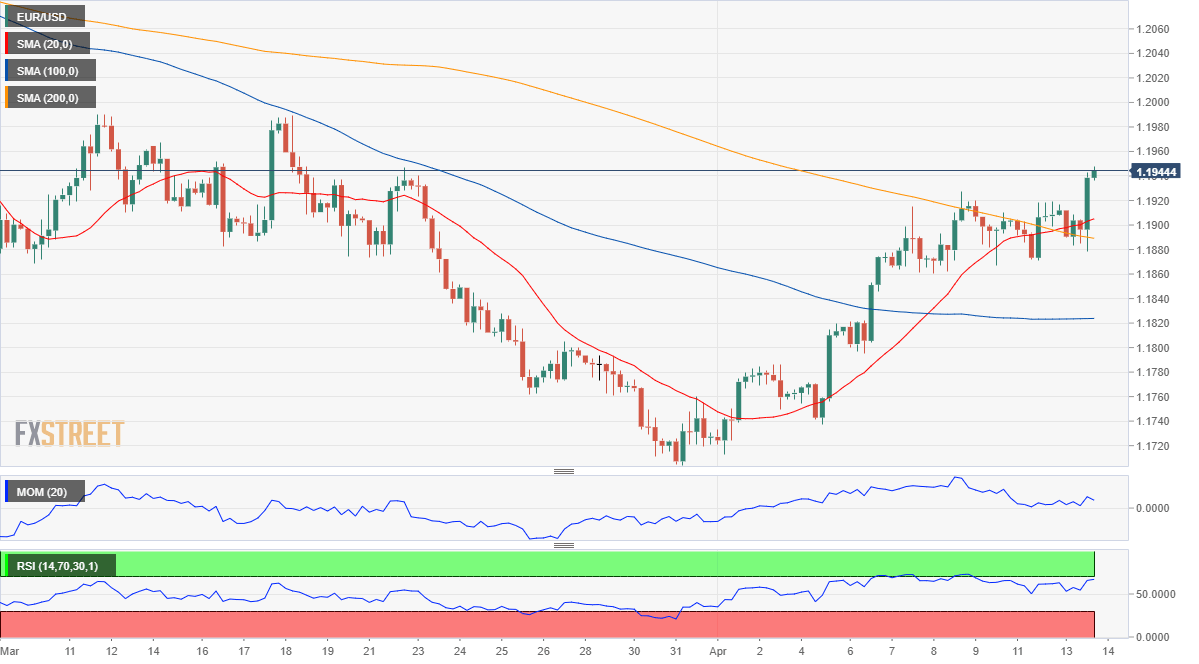

EUR/USD Current Price: 1.1944

- Upbeat US inflation figures spurred risk appetite, to the detriment of the greenback.

- The German ZEW survey showed that business sentiment deteriorated sharply in April.

- EUR/USD is bullish in the near-term and could extend its advance beyond 1.2000.

The EUR/USD pair surged this Tuesday to a fresh 3-week high of 1.1947, ending the day nearby. The dollar advanced at the beginning of the day, gaining the most strength ahead of Wall Street’s opening and after the FDA paused the application of the Johnson & Johnson coronavirus vaccine due to at least six cases of severe blood clots related to the shot. Stocks plummeted, providing temporary support to the greenback, although the release of US inflation data put a halt to equities´ slide and pressured the greenback.

The US March Consumer Price Index jumped to 2.6% YoY, while the core reading hit 1.6%, both beating the market’s expectations. US Treasury bond yields ticked higher as an immediate response to the headline but edged lower afterwards. Earlier in the day, Germany published the ZEW Survey on Economic Sentiment, which missed the markets’ expectations, as business sentiment contracted to 70.7 in April in the country and to 66.3 in the EU.

On Wednesday, the EU will publish February Industrial Production, expected to have declined by 1.1% in February. The US macroeconomic calendar has little to offer, although US Federal Reserve chief Jerome Powell is due to speak at the Economic Club of Washington, while multiple other Fed’s officials will participate in different events.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair is trading near the mentioned daily high ahead of the Asian opening, bullish in the near-term. The 4-hour chart shows that the price is comfortable above all of its moving averages, with the 20 SMA crossing above the 200 SMA, both around 1.1900. Technical indicators have advanced within positive levels, partially losing their strength near overbought readings.

Support levels: 1.1920 1.1870 1.1825

Resistance levels: 1.1965 1.2000 1.2045

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.